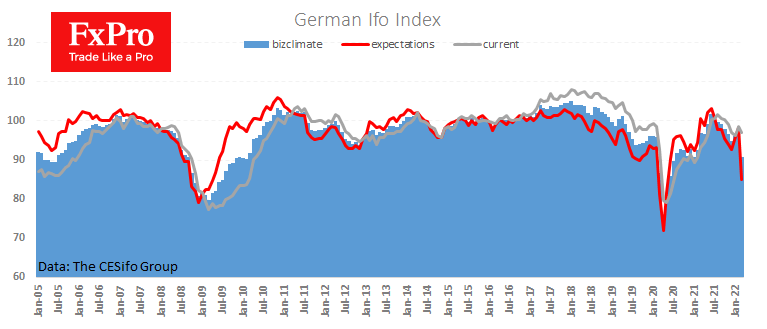

According to fresh Ifo estimates, business sentiment in Germany fell in March to its lowest level since January 2021. The business climate index fell from 98.5 to 90.8 following a collapse in business expectations amid war in Ukraine and the associated surge in energy and several other commodity prices.

The drop in economic expectations was comparable to what we saw exactly two years ago at the start of the pandemic. New sentiment data may prove to be the first indication of the depth of the economic losses in the next quarter or two from ongoing events. They could wipe out as much as 1% of GDP in the outgoing quarter and another 2% in the next.

However, the current scenario is already priced in the financial markets. The Eurozone stock indices, which often outperform the economic cycle, are now more than 15% above their lows of March 7th. The same can be said for the euro, which is firmly based around USD 1.10, which has been stable for the last three months against the pound and strengthened by more than 8% against the Japanese yen.

The FxPro Analyst Team