The Federal Reserve’s average inflation policy and the threat of an asset bubble aren’t moving the stock market. It shows that investors are still skeptical toward the Fed that it would let inflation run high. At least in the near term, State Street senior macro strategist Marvin Loh believes a bubble isn’t a concern.

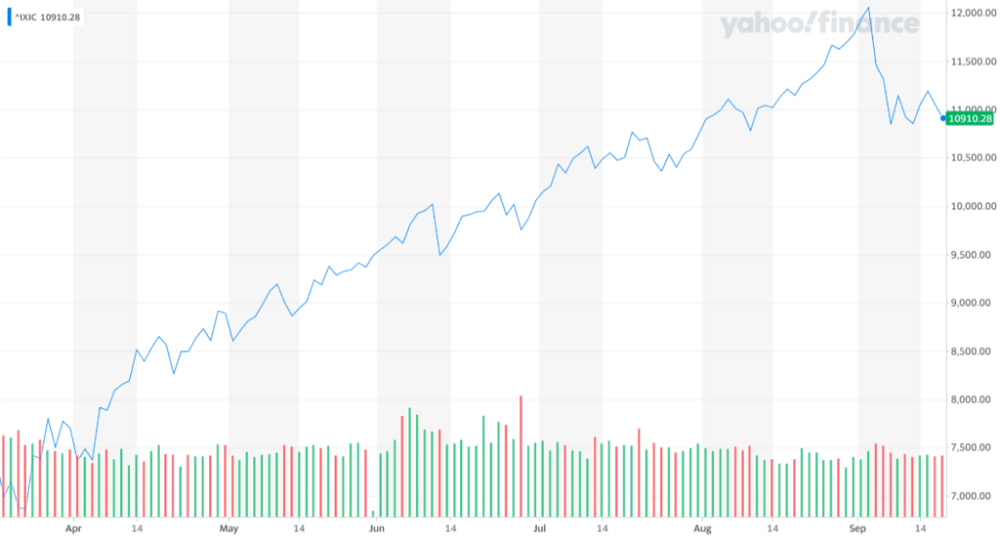

Although the stock market has slumped in recent weeks, it makes a prolonged bull run in 2020 more likely. According to Loh, a bubble could become a concern in 2021 and possibly in 2022. In the foreseeable future, he said it is challenging to see it as an immediate problem. In the past month, the Nasdaq Composite and the S&P 500 dropped by 9.51% and 6.25%, respectively.

Some investors fear a deep stock market pullback arising from the risk of inflation creating asset bubbles. But as CCN.com reported, 5% to 7% corrections even during bull cycles are typical. Moreover, despite the 9.51% decline in 16 days, the Nasdaq Composite soared by 59.03% since March 23. At its yearly peak, the Nasdaq Composite climbed by 75.73%, which made a correction inevitable.

Considering historical inflation cycles and stock market trends, Loh said an inflation-triggered bubble isn’t a risk in the near term. He said: “I don’t think [a bubble] is a concern now. But it probably will be if this continues as we go into next year and probably 2022. They can look past it now, given how many challenges they see in the economy.”

Favorable Backdrop for the Stock Market Continues

The uncertainty around inflation remains, but the Fed’s policy continues to act as a favorable backdrop for the stock market.

As long as the Fed doesn’t go in overdrive with inflation, a low-interest rate would continue to fuel the appetite for high-risk assets. Such a relaxed financial environment boosts the prospect of a prolonged stock market uptrend in the near term. The one missing catalyst that could further propel stocks is a strong dollar. Investors are optimistic around Chinese stocks due to the strengthening of the yuan.

Wall Street Strategist Pops Stock Market Bubble Fears Until 2022, CCN, Sep 18