Asian markets are developing demand for risky assets. Japan’s Nikkei225 has gained 1.5% since the start of the day on Monday, thanks to a weaker yen. Bargain hunters are buying shares of IT giants on the Chinese markets on signs that a constructive dialogue between the US and China on trade has returned.

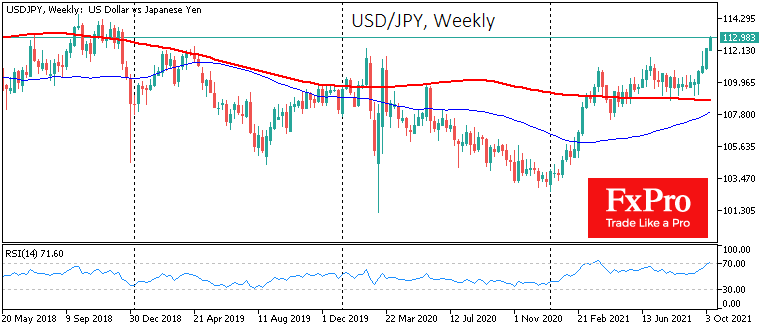

The yen is methodically selling off against the dollar. Since the last Fed meeting on September 22nd, the USDJPY rose 3.4% from levels around 109 to the current 113 with a slight pause which investors took to balance portfolios.

This rally was triggered by the difference in monetary policy dynamics between the Federal Reserve and the Bank of Japan. The American regulator continues to move away from crisis measures, promising to soon cut back on its balance sheet purchases. In an era of near-zero interest rates, this is the main instrument of monetary support. In contrast, no such move is expected from the BoJ.

The pressure on the yen against the dollar is also due to a surge in energy prices, which Japan predominantly imports, while the USA has its reserves and production. The jump in oil, gas and coal is putting pressure on the trade balance, turning historically surplus values into deficits. The situation is similar in other countries that actively import commodities.

It is worth noting that before the pandemic, the USA briefly became a net energy exporter. Now oil and gas production is down, and reserves are falling, but the US has considerable potential to ramp up production. Thanks to the diversification of the economy, the US market in general and the dollar are not as exposed to pressure from surging oil and gas prices.

Meanwhile, energy prices have returned to the upside. WTI surpassed $80 on Monday morning, renewing its highs since 2014. The price of US natural gas stabilised near $5.84, pulling back from extremes of $6.5, while more than doubling 2020 support levels at $2.5.

The Americans continue to ramp up production, which has already increased to 11.3m BPD. Further growth in drilling activity promises to translate into increased production over the next 6-9 months. The US energy sector thus promises to benefit from a red-hot energy market. It is not surprising that US lawmakers have abandoned further interventions to sell oil reserves from strategic reserves in such an environment.

A weaker yen supports interest in equities, returning the Nikkei225 to growth. At the same time, high and rising energy prices pose a serious threat to corporate earnings, which is harmful to the stock market and will require an expansion of support programmes from the Bank of Japan.

The FxPro Analyst Team