The Japanese yen leads in losses against the dollar amongst the G10 currencies. And so far, there are indications that the USDJPY’s rising trend will only be interrupted by technical corrections in the coming weeks or months.

The main fundamental driver for the USDJPY is the substantial divergence in the US and Japanese monetary policy. The former has raised its key rate by 150 points in the last three meetings and started selling assets off the Fed balance sheet. The latter has maintained its crisis rhetoric, promising to continue with QE and increasing bond purchases to keep 10-year yields close to 0.25%.

The currency market is not only wagering on the present but is actively putting expectations into prices. From this perspective, the USDJPY exchange rate results from an overlay of the key rate expectations, which are best reflected in 2-year bond yields. The spread started rising steadily in early 2021, at the same time as USDJPY began to rise.

The spread between the US and Japanese 2-year yields exceeded 3% this month, reaching 3.5%, the highest since 2007, although it was only 0.25% at the beginning of last year. Approaching a spread of 3% has not stopped the Fed from tightening, nor the Japanese rhetoric, so it makes sense to tune in to a return to pre-World Financial Crisis norms, i.e., above 4.3% versus 3.2% now, leaving the potential for around a third of the movement that already passed.

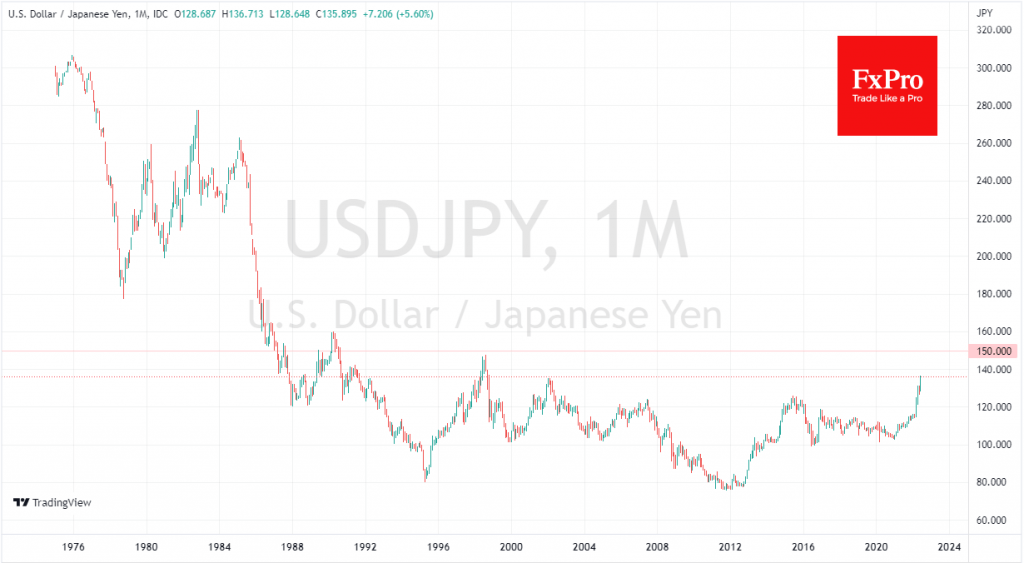

If these correlations between the USDJPY and US-JP 2-year yield spreads remain in place, we could see the dollar continue to rise to 150 yen, last seen in 1990 and twice as high as the historic lows of 2011.

Suppose the Japanese monetary authorities and the Ministry of Finance manage to steer the yen through such a devaluation, preserving confidence in the financial system. In that case, this could revive the economy by raising export competitiveness, potentially returning the Land of the Rising Sun to export-oriented status.

The FxPro Analyst Team