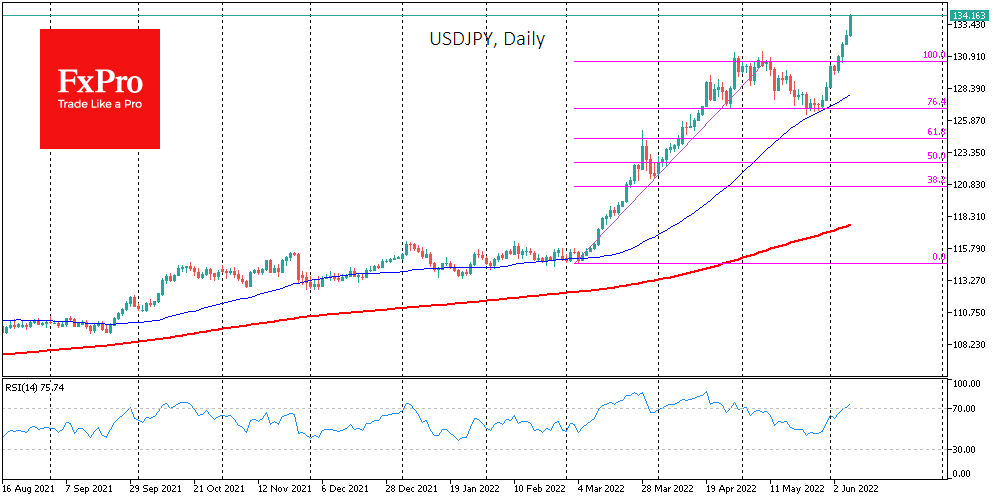

The USDJPY has added for the sixth trading session out of the last seven, this week renewing 20-year highs. The pair reached 134, getting very close to the extremes of January 2001, near 135.

We see that this new momentum is as strong, if not stronger, than what we found in March-April. The first impulse was a 14% weakening of the yen against the dollar for two months. The central bank and finance ministers started to talk down the yen, indicating that a sharp deterioration was undesirable.

The pullback, triggered by verbal interventions and speculation that the BoJ might reduce QE to tighten policy and protect the yen, only bought time but turned the market around.

In the last days of May, it was clear that the monetary watchdogs favoured continued stimulus and did not change their policy. This mood contrasts sharply with the active policy tightening moves in the USA in many other developed countries and is a fundamental reason for using the yen as a funding currency.

If the Bank of Japan manages to conduct a controlled landing of the yen at another, fundamentally lower level, it would restore competitiveness to Japanese exports and provide a driver to turn on the industrial engine, which has often stalled in recent years.

In the meantime, investors and traders should be prepared for a permanent yen decline over this year or the first half of the next one if we now see Europe and the US abandoning their zero-interest-rate policy, as policymakers there hinted recently. For its part, Japan will likely remain tied up in an anaemic economy riddled with sovereign debt, which will not allow for an adequate increase in government stimulus to spur growth.

All that sets the stage for USDJPY to move up towards 140 in the coming weeks and 150 before the end of the year. However, the tight correlation between the yield on 10-year US Treasuries and the USDJPY dynamics suggests that without an economic disaster in Japan or the global economy, a fixation above 150 is unlikely.

The FxPro Analyst Team