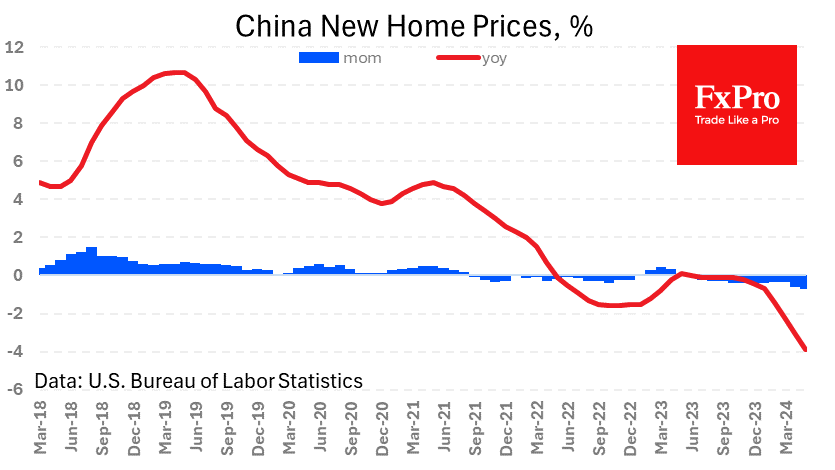

China’s housing price decline is gaining momentum. New home prices for May fell 0.71% vs. 0.58% and 0.34% in the previous two months. The year-over-year decline increased to 3.9%, with back-to-back slides over the 12 months. China has repeatedly announced measures to support the property market, but they have been limited, failing to reverse the trend. The problems in the housing market are very toxic for stocks as housing prices and sales volumes drag down property developers and banks, sucking liquidity out of the financial system.

The other bad news was the slowdown in industrial production growth to 5.6% from 6.7% a month earlier, worse than the expected 6.2%. The slowing trend in China’s industrial growth has been in place since the peak in February. China’s industrial production can be seen as a leading indicator of the global economy, and the fresh data raises the risk of a recession in developed economies before the end of the year. Fixed asset investment is also losing momentum, falling to 4.0% against a peak of 4.5% in March and an expected 4.2%.

Retail sales, on the other hand, strengthened growth and beat expectations. The year-to-date gain to May was 3.7% vs. 2.3% previously and 3.0% expected. It cannot be ruled out that this is only a temporary surge, and its positive effect is unlikely to be global.

These data and statistical reports last week failed to lift renminbi volatility. The USDCNH pair seems to have found its ceiling just below 7.27, having been turning downwards from there since the end of March. That said, the downside momentum is getting smaller and smaller, preparing us for a new floor. Next, which seems to be more important for the Chinese authorities, is 7.35. From here, USDCNH was actively sold from August to November last year, and there was a powerful reversal in November 2022. The yuan will be able to sag to this level if there is still a pullback from risks and towards the dollar in global markets. But it will probably take an economic crisis to overcome it.

Technically, it is now more comfortable to be bullish in USDCNH as the previous 2019-2020 global “ceiling” below 7.20 this year works as a “floor”.

The FxPro Analyst Team