The official services and manufacturing PMIs were much weaker than expected, adding to the move into defensive assets on concerns over China’s economy.

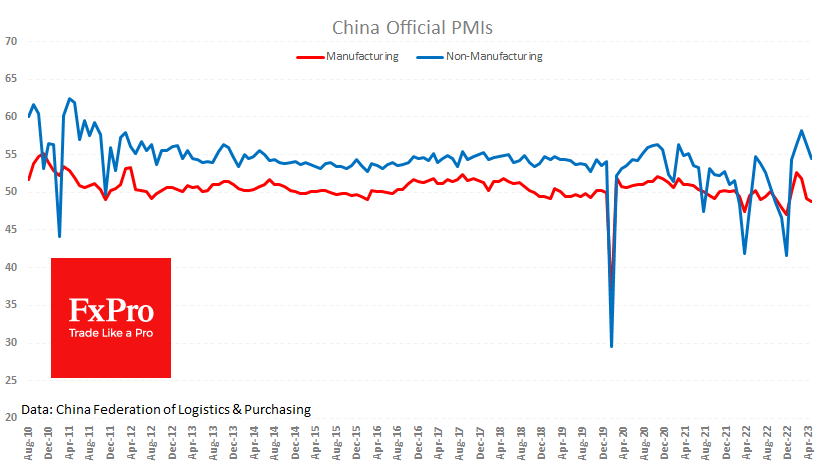

The Manufacturing PMI fell from 49.2 to 48.8 instead of the expected 49.5. Readings below 50 indicate a contraction in activity during the month. Excluding periods of contraction due to lockdowns, this is the lowest level for the index in at least 13 years. Prices were the main driver of the decline, but falling order books and inadequate market demand were equally worrying.

The Services PMI fell from 56.4 to 54.5, below the expected 55.1. While these levels are below expectations, they align with the historical norm we saw before the coronavirus.

The weak data triggered a fresh sell-off in the renminbi. The USDCNH pair was above 7.12 at the start of European trading, its highest level since November last year. Over the past three weeks, the pair has hit new highs almost daily. Unlike in March and December, the central bank has not prevented the renminbi from weakening around the 7.0 level.

A weaker local currency benefits exporters as it increases their global competitiveness. The main side effect is higher inflation. But this is fine for China, where the CPI fell to 0.1% y/y in April, and the PPI lost 3.6% y/y. Perhaps all these effects are what the People’s Bank is trying to achieve.

The weak economy, low inflation and the central bank’s apparent resistance to the Renminbi weakness suggest that the USDCNH pair will continue looking for a top. The closest landmark is the 2019 and 2020 highs at 7.19, which the pair can reach relatively orderly within a few weeks and maintain the current momentum. However, one should be prepared that the recent move will be exhausted before the renminbi weakens to 7.3 per dollar, approaching last October’s highs.

The FxPro Analyst Team