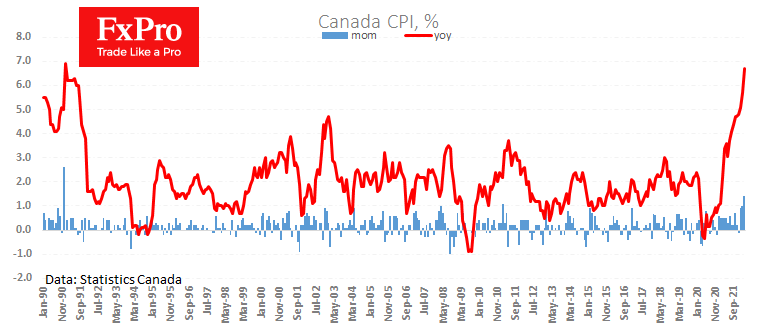

Canadian consumer inflation rose stronger than expected, adding 1.4% for March and accelerating to 6.7% y/y from 5.7% a month earlier and the forecasted 6.1%.

The Bank of Canada last week raised its key rate by 50 points and announced a quantitative tightening in response to accelerating price growth. The fresh batch of data has triggered a new buying spurt in CAD against USD as it opens the door for even more tightening of monetary policy.

Canada is benefitting from a boom in commodity and energy prices, which allows the central bank to pursue a more aggressive policy normalisation than countries that are net importers of these commodities. In this situation, the CAD is getting support from three sides: more money coming into the country, more business activity, and a potentially stricter monetary policy.

The USDCAD is losing 0.75% to 1.2510, and it is trying to break the tie with 200-day MA, which has been resistant for the last two weeks. The important close frontier is 1.2475, where the pair got support in April and January. A consolidation below that might be the first signal to end the corrective bounce of the USDCAD and clear the way to 1.2000, which is the low of May 2021.

The FxPro Analyst Team