The Dollar’s demise continues following the Fed’s monetary policy framework changes. The dollar index has rewritten its August lows, falling to a new dip since May 2018.

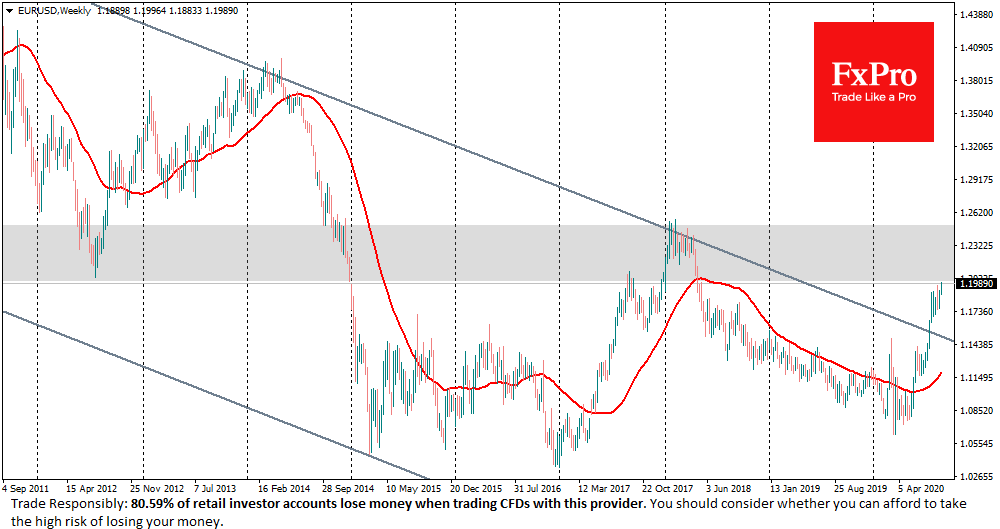

The world’s most popular currency pair, EURUSD, is trading one step away from an important milestone 1.2000, close to its highs since April 2018.

The charts clearly show how the dollar bulls are gradually losing ground. At the beginning of August, they kept the counterstrike at 1.1900, and a couple of weeks later, they had to fight back from 1.1950. This morning, however, they also failed to maintain this level during the Asia session, pushing it to 1.1996.

Earlier in 2020, we already witnessed the mid-term trend break down, with EURUSD overtaking the 200-day average at the end of May with a strong move. Later in July, it broke the resistance of a multi-year downward trend. This level has already worked out in August as strong support.

By confidently entering the area of 1.2000, EURUSD can very quickly reach 1.2500 before the US presidential election. This area also coincides with the peak values of the pair in 2018.

Investors are already wondering about the long-term stability of the Dollar. Further rapid weakening may trigger an even more nervous cycle of selling dollar assets.

Looking for further signs of USD weakness, one should note the rally of the Chinese currency. On Tuesday morning, USDCNH dropped to 6.82 and has declined over nine weeks out of the last ten, losing 3.7%, a big move for this currency pair. As a result, the Chinese yuan managed to beat back more than 38% of the decline caused by trade wars and the pandemic. Further decline paves the way for 6.70, the next area of exchange rate consolidation.

Investors are confidently buying Chinese currency and shares while selling the Dollar to a wide range of competitors. Isn’t this a sign of whom they consider the winner in the confrontation between the two world’s largest economies?

Buffett, who recently turned 90, has increased his suspicion of the American market by buying shares in Japanese companies. He is a well known pro-American investor, but now, probably, considers them overestimated, simultaneously not wishing to further sit on a couple hundred of billions of dollars in cash.

The FxPro Analyst Team