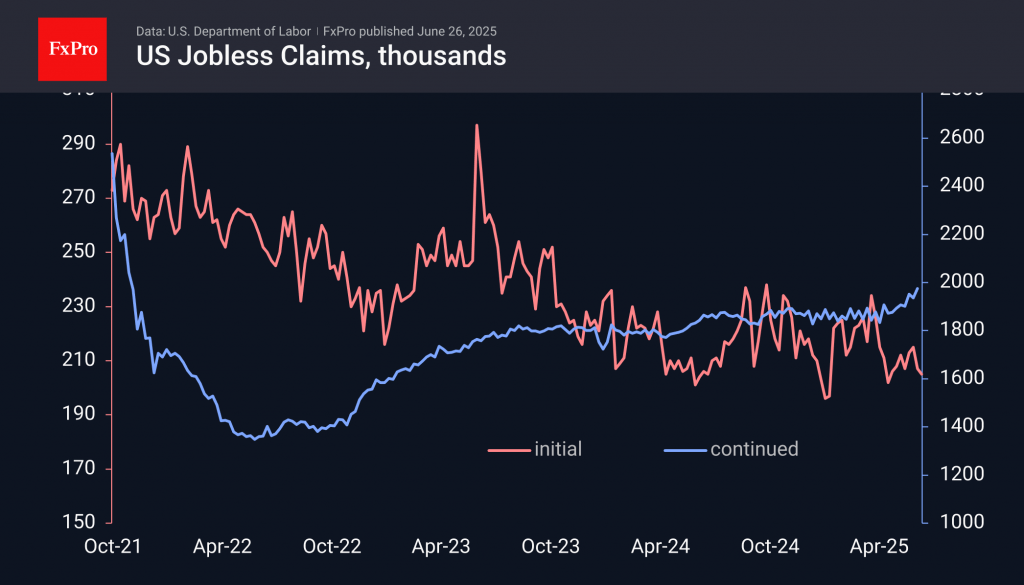

Weekly benefit claims indicate a deteriorating labour market. The number of repeat claims rose by 37K in the week ending 14 June (latest data) to 1.974 million, reaching its highest level since November 2021. The plateau in this indicator in mid-April was replaced by an upward trend, adding a total of 141K.

Excluding the volatility during the coronavirus pandemic, the last time such high values were seen was in 2017. Back then, that increase in unemployment did not turn into a recession, and the labour market soon returned to normal.

Although small, this is yet another coin in the piggy bank of indicators pointing to the economy cooling down. Other signals include the real estate sector and low consumer confidence figures.

In this light, it is worth paying close attention to the official monthly employment statistics, which will be released next Thursday (Friday is a public holiday in America, 4 July).

The FxPro Analyst Team