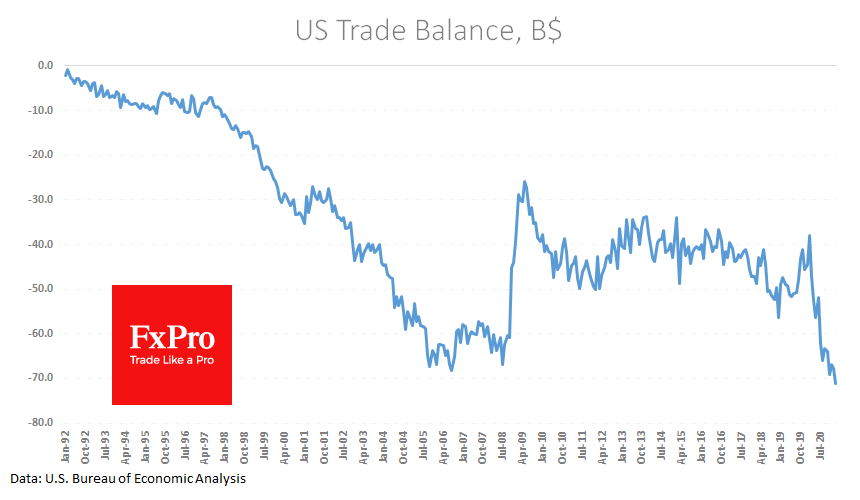

The US trade deficit updated to a record high of $71.1bn in February. The widening trade deficit is bad news for the dollar as it reflects capital outflows from the country in favour of other currencies.

For the global economy, the fresh trade data is somewhat alarming, as the drop is caused by an accelerated fall in exports over imports.

Potentially, this could be the end of the V-shaped recovery, and the start of the L-phase observed from 2011 to 2014.

This situation is comparable with the 1997-2005 trend when the deficit widened due to accelerated US consumption growth. At that time, the dollar was depreciating against the high-speed expansion of emerging markets partly due to rising exports to the USA.

The fall in exports, if sustained, risks being a reflection of falling global demand, as most countries, unlike the USA, don’t have unlimited access to debt markets to finance support packages. And this is bad news for the demand for risk assets, primarily equities and commodities.

The FxPro Analyst Team