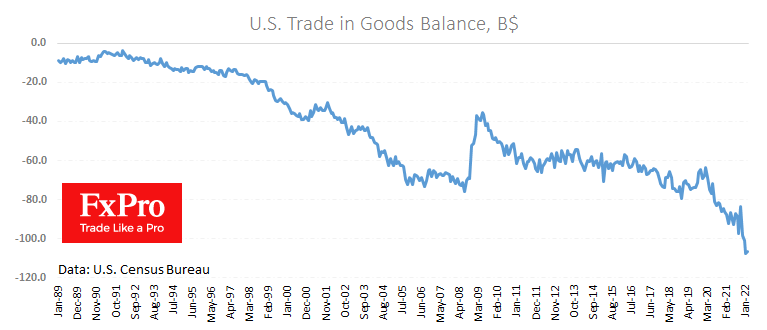

According to preliminary data from the US Bureau of Economic Analysis, the US trade deficit stalled last month. Imports exceeded exports by 106.6bn in February, down slightly from 107.6bn a month earlier, offering little consolation.

The US has remained a net importer of goods throughout modern history since 1989. Except for the most acute phase of the global financial crisis, the deficit trend has stabilised and accelerated sharply in 2020 following the renminbi’s appreciation because China is the leading trading partner of the USA.

On the macroeconomic analysis side, tight deficits are a negative for the dollar, which pays for goods. However, the currency is affected by a cocktail of heterogeneous factors. Since last August, the acceleration of deficit growth has been accompanied by a strengthening of the US currency against significant competitors. Other developed countries have even less capacity than the USA to respond to inflation.

The FxPro Analyst Team