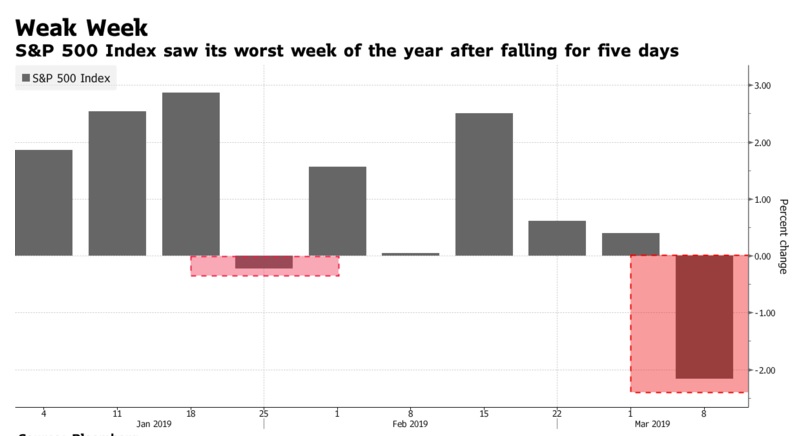

U.S. stocks slumped with the dollar after a report showed American hiring was the weakest in more than a year while wage gains were the fastest of the expansion. The S&P 500 Index closed slightly lower for its fifth straight drop and worst week of the year, and Treasury yields fell to a two-month low amid concern the labor market is starting to slow. Shares pared declines late in the day as some analysts focused on the longer-term positive trend for jobs. The Stoxx Europe 600 Index sank the most in a month after Asian shares dropped. The euro climbed after closing at its lowest level since 2017 on Thursday, when the European Central Bank slashed growth forecasts.

Investors had been waiting for the jobs report to provide more clues on the state of the world’s biggest economy and were surprised to learn U.S. nonfarm payrolls increased by 20,000 last month, trailing estimates for a 180,000 increase. The news came a day after ECB President Mario Draghi delivered fresh stimulus as he downgraded the outlook for the euro area. This week, China cut its goal for economic expansion, the Bank of Canada dialed back its expectations for policy tightening and the OECD lowered its global outlook.

The S&P 500 Index fell 0.2 percent at the close of trade in New York. The Dow Jones Industrial Average dipped 0.1 percent; its fifth consecutive decline was the longest losing streak since June. The Stoxx Europe 600 Index sank 0.9 percent. The U.K.’s FTSE 100 Index dropped 0.7 percent. The MSCI Emerging Market Index fell 1.3 percent to the lowest since January.

U.S. Stocks Cap Worst Week of 2019 After Jobs Data, Bloomberg, Mar 09