US equities are trading sideways despite a robust economy, in stark contrast to European indices, which consistently reach new highs despite economic weakness. The disparity in monetary policy effectively accounts for this divergence in market dynamics.

On the eve of the meeting, Federal Reserve Chairman Jerome Powell said that the FOMC could adopt a wait-and-see approach and hold off on rate cuts. The Fed fears the risks of a new acceleration of inflation due to tariffs. At the same time, we should not lose sight of the fact that policy easing at full employment can cause the economy to overheat, triggering an inflationary spiral.

This approach is not a surprise but only a development of the signals that the Fed has been giving for the last month. The latest FedWatch Tool estimates give a 95% probability of keeping the key rate on 19 March, compared to 75% a month ago and 83% a week ago.

Interestingly, the shift in those expectations has done little to help the dollar. The dollar index is now roughly where it was in mid-December when the first signals of a pause in Fed rate cuts were received.

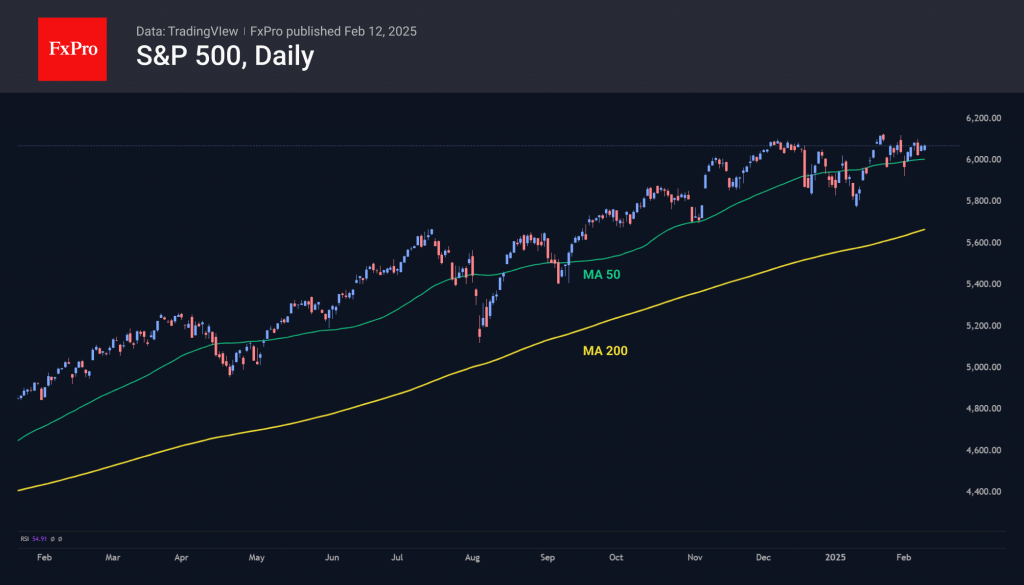

The US stock market, represented by the S&P500, is also trading at about the same levels as it was two months ago. However, markets in Europe, by contrast, have shot up, updating historic or multi-year highs. For example, Germany’s DAX has gained 13%, while the Euro Stoxx 50 is up around 12% since December 20. Meanwhile, the UK’s FTSE 100 has risen approximately 9% over the same period.

However, extrapolating such dynamics into the future would be an oversimplification. US macroeconomic indicators are clearly in better shape, although they are not showing acceleration. For markets, this suggests a good opportunity to lock in earlier gains. Still, it doesn’t present a strong case for a major equity sell-off, especially given the strength of corporate earnings.

Simply put, US stocks are facing the effects of a high base and inflated expectations. European indices, which have been rising at an outperformance over the past few months, are acting as a catch-up given the period of multi-year underperformance of US equities. Sooner rather than later, investors will start looking for opportunities in Europe. If they don’t, stocks could face trouble.

The FxPro Analyst Team