Indices

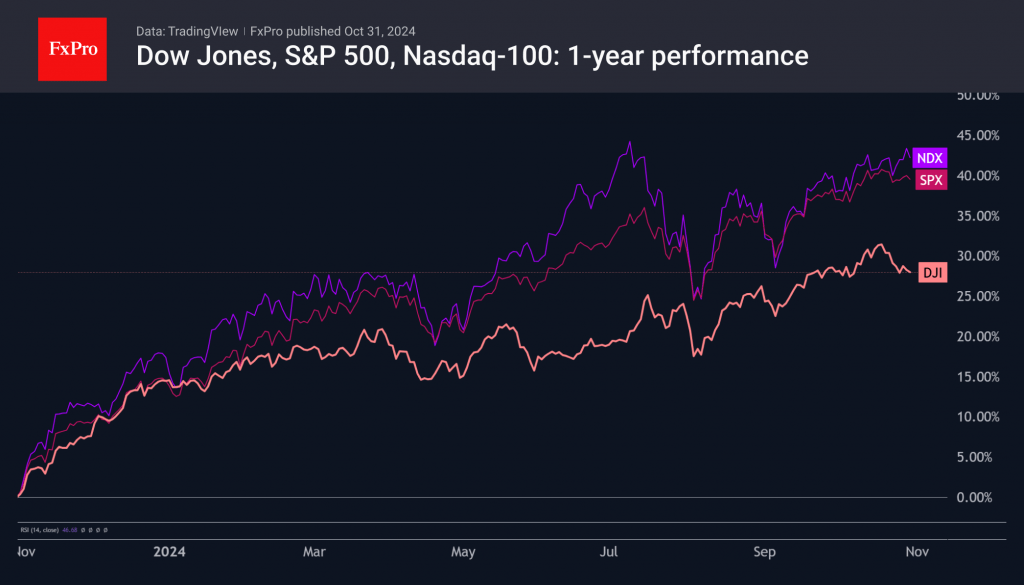

The major US indices began the week with an attempt to return to growth but were choked by selling. Once again, the laggard was the Dow Jones, which slipped below last week’s lows, losing 3% from its previous high on 21 October to levels near 42000. The Nasdaq100 briefly approached 20700, almost repeating its mid-July high, but the cold reception to reports from heavyweights Microsoft, Meta, and others triggered a fresh wave of selling.

Back then, the Nasdaq100 went down 18% from its July highs, close to bear market territory, and tested the strength of its 200-day moving average before turning upwards. Nowadays, the 200-day moving average is at 18900, and the bear market threshold is at 16600.

Historical seasonality is now on the side of the bulls, both in the six-month outlook and for the rest of the year. But many remember well that the 2022 bear market began in November 2021 with a peak in the Nasdaq.

Stocks

The outgoing week had the most weighted companies reporting. Their combined capitalisation exceeded 50% of the weight of all S&P 500 constituents. The market’s reaction to the performance of the heavyweights was mixed.

Alphabet has been working on the efficiency of its A.I. solutions, with a focus on lowering the asking price and creating value for advertisers. It seems this shift in focus to practical implementation was needed by investors, who rewarded the company with a 6% rise in its share price after the report, with a slight pullback the next day.

It’s a different story for Microsoft, which lost up to 5% in after-hours trading on unimpressive results from its Azure cloud business. We also see a 5% drop in net margin to 34 billion for the quarter, compared to Alphabet’s 13% rise to 28 billion.

Meta impressively beat forecasts but is losing ground after the report. We attribute this to the outperformance of the share price, which was most pronounced in the second half of the year. Since the beginning of the year, Meta shares have gained more than 70%, while Alphabet has gained 26%, and Microsoft has gained just 16%. By comparison, the benchmark S&P500 is up 23% over the same period.

The FxPro Analyst Team