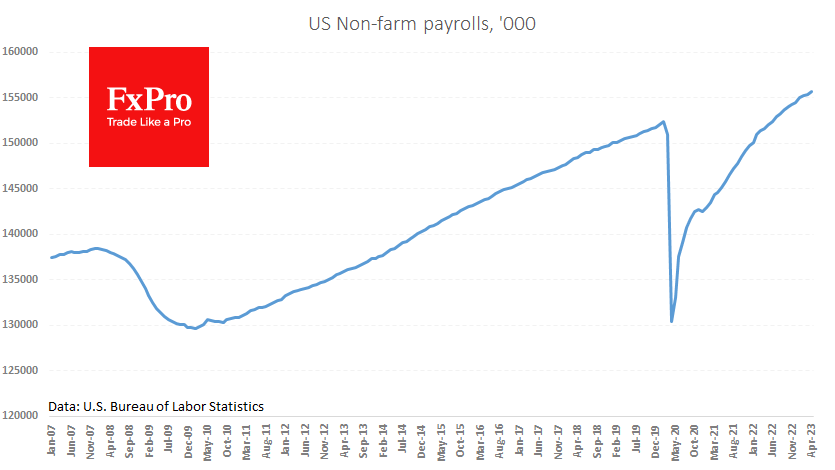

In April, the US economy added 253k jobs, surpassing expectations of 181k. Over the past 12 months, actual data has consistently exceeded expectations for this indicator. However, the previous month’s downward revision was considerable, from 71k to 165k.

The unemployment rate fell to 3.4%, beating analysts’ expectations of an increase from 3.5% to 3.6%. The labour force participation rate remains high at 62.6%, approaching the pre-COVID-19 shutdown level of 63.4%. The recovery can be attributed to a reduction in fear of illness and higher inflation, pushing people into work to maintain their standard of living.

Average hourly earnings rose by 0.5% m/m and 4.4% y/y, better than expected. Despite the rise in employment, the index of total hours worked per week has remained flat since the start of the year, a worrying signal also seen in 2007 and at the end of 2019.

Initially, the market reacted with technical selling of the dollar and buying of equity index futures but quickly digested the news and speculation that there are too few signs of inflationary overheating to force the Fed to raise rates further.

The current report argues for keeping rates at current levels for longer. A healthy labour market typically helps the dollar and stock market by highlighting the strength of the US economy compared to other investment destinations.

The FxPro Analyst Team