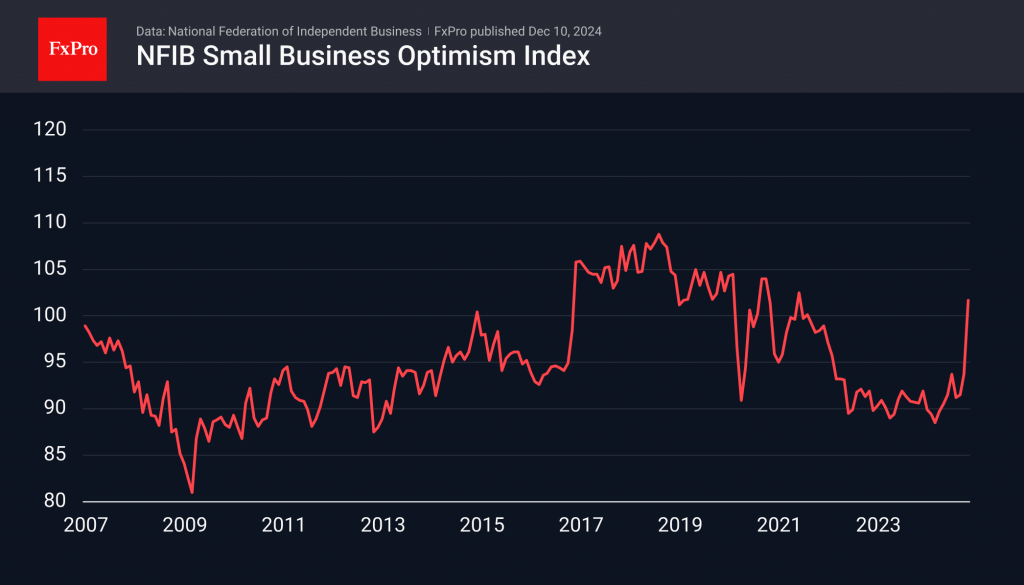

Small businesses have become more optimistic since the November election, as evidenced by an eight-point jump in the Small Business Optimism Index. There was a similar jump in 2016 following Donald Trump’s victory.

The index jumped to 101.7, above its historical average of 98, with improvements in nine out of ten components (current inventory unchanged). The biggest gains were driven by expectations of an improving economy.

Promises of protectionist policies and tax cuts have fuelled these expectations. Between November 2016 and September 2018, the Russell 2000 index of small-cap companies gained almost 50%, compared with around 35% for the S&P 500. The initial surge in the Russell 2000 on Trump’s victory explains the expectation of outperformance by smaller companies. However, since early December, this index has been falling based on expectations of tighter monetary policy for the foreseeable future. In contrast, the Nasdaq100 and the S&P500, which are filled with giants and less sensitive to interest rate movements, are regularly hitting all-time highs.

Will this divergence continue, or will we see a return to the 2016-2018 pattern? We are leaning towards the latter scenario but would prefer to see confirmation first in the form of the Russell2000 updating highs above 2460.

The FxPro Analyst Team