US retail sales showed unexpectedly weak growth, adding only 0.3% for November against expectations of 0.8% and 1.8% a month earlier. This release triggered a strengthening momentum in the dollar, with the DXY rising 0.2% immediately after the release. EURUSD is making a new weekly low at 1.1240.

While the latest data is noticeably lower than expected, one cannot ignore the sharp rise of previous months. US sales are measured in money and are not inflation-adjusted. A price increase of 0.8% for November indicates a real decline in retail sales. However, it is still worth considering that by the same month a year earlier, sales were up 17.9% against a 6.5% increase in prices.

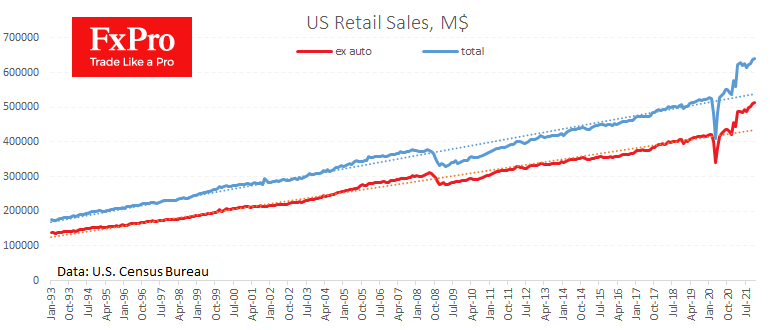

The chart clearly shows how the current sales level has broken away from its multi-year trend line. And this gap is partly due to logistical problems and is feeding inflationary pressures. What if the Fed aims to deflate this bubble? It seems, however, politicians are unlikely to announce such intentions.

The FxPro Analyst Team