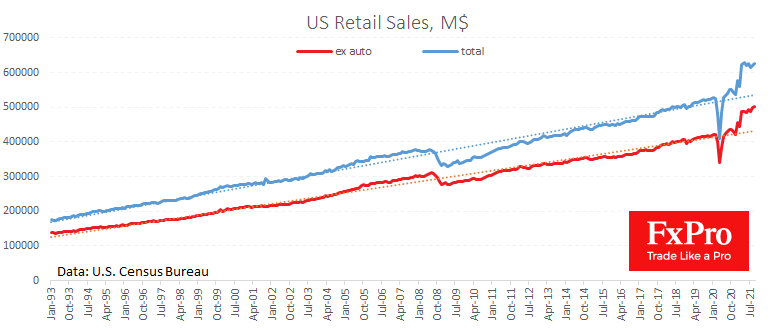

US retail sales significantly exceeded expectations, continuing a series of healthy data supporting global risk demand. US Census Bureau reported a 0.7% rise in sales for September after a 0.9% (revised from 0.7%) increase a month earlier.

Sales excluding autos added 0.8% after jumping 2% earlier. This is solid data and has the potential to allay some fears that the impending Fed stimulus rollback will come as a shock to equity markets. Investors may well be satisfied with the report and strengthened in the belief that demand will continue to enhance soon.

Strong retail sales are also good news for the Dollar, as markets continue to put an increasingly early hike in interest rates into quotes. The latest data indicates that the first rate hike is already priced in as early as September next year, although only a couple of months ago, no one was expecting a hike before 2023. The approach of the projected rate hike date is pushing the Dollar upwards.

The FxPro Analyst Team