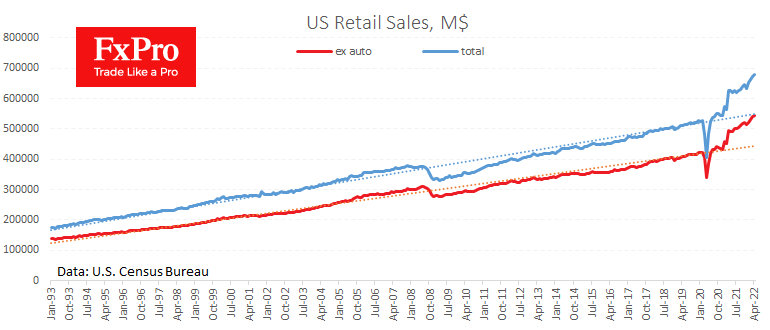

US retail sales continue to grow strongly, adding 0.9% in April after 1.4% a month earlier and slightly weaker than the expected 1.0%.

Sales excluding autos and gasoline rose 0.6% after 2.1% a month earlier and against an expected 0.4% increase.

Remember that we see data adjusted for seasonal factors but not for price adjustment. The cost of goods sold in April was 8.2% higher than in the same month a year earlier, which is lower than the 8.3% CPI growth over the same period.

Nevertheless, we see that sales growth keeps pace with inflation, which might boost the demand for risky assets in the financial markets. Continued strong demand for goods and services is somewhat easing fears of falling corporate earnings and raising hopes that the economy can cope with the policy tightening that started in March.

The FxPro Analyst Team