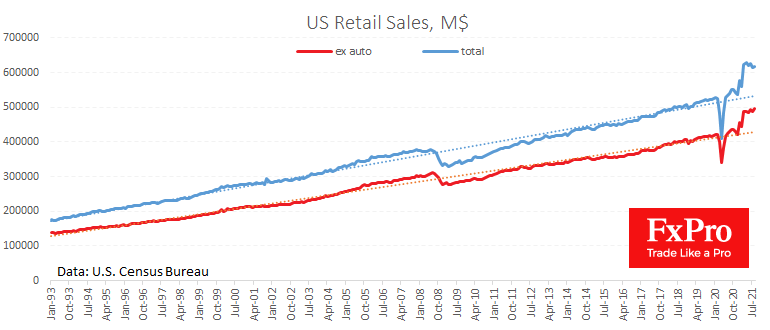

The US Retail sales notably exceeded expectations, adding 0.7% in August vs an expected 0.7% decline. The increase to August last year is an impressive 14.9%, dismissing fears that Americans are cutting back on spending by spending their government bailout checks and being left without an allowance for unemployment benefits. The low-base effect had already worn off in July, so this number shows that Americans’ interest in shopping remains elevated.

Excluding autos, sales have updated to record levels, adding 1.8% for the last month.

Fears that a collapse in consumer sentiment would cut retail sales have not yet been confirmed. Other indicators released at the same time as the sales report also give hope for the better. The latest jobless claims data updated its low since March 2020, falling to 2.665M. The Philadelphia Fed manufacturing index returned to the July level of 30.7, confirming optimistic estimates of a similar index from the New York Fed released on Wednesday.

This strong data can support demand for US assets, including the dollar and US equities. They could reinvigorate dollar buying against rivals, indicating an approaching date for the start of the Fed’s tapering. At the same time, a strong economy is a significant long-term driver of support in stocks, suggesting higher corporate earnings. In contrast, China and Europe are showing a more severe slowdown in the recovery, holding back demand for risk in those regions.

The FxPro Analyst Team