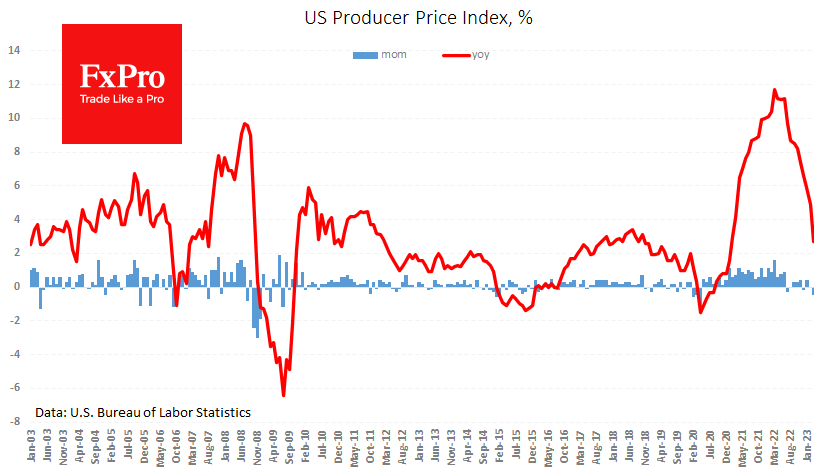

US producer prices are the real inflation surprise. A real shock followed yesterday’s mild disappointment in consumer inflation in producer prices. They fell by 0.5% in March, and the annual growth rate fell from 4.9% to 2.7%. This is the lowest level since January 2021, but more importantly, it is close to the average for this type of inflation over the last 20 years.

For now, the market is celebrating the sharp divergence between expectations and reality on inflation by buying more risky assets and selling the dollar. Interest rate futures are already pricing in a 40% chance that the Fed will leave rates at current levels in early May. This is still not a critical reversal, as a week and a month ago, these odds were over 50% (and on 13 March, there was an 18% chance of a cut).

This problem is receding into the background, and the Fed’s focus can now turn to wages and prices in the service sector. So far, the only solution to this problem is a drastic economic growth slowdown. This is probably related to the Fed’s expected moderate inflation this year. This could signal that the central bank will put the brakes on monetary policy, contrary to market expectations.

The FxPro Analyst Team