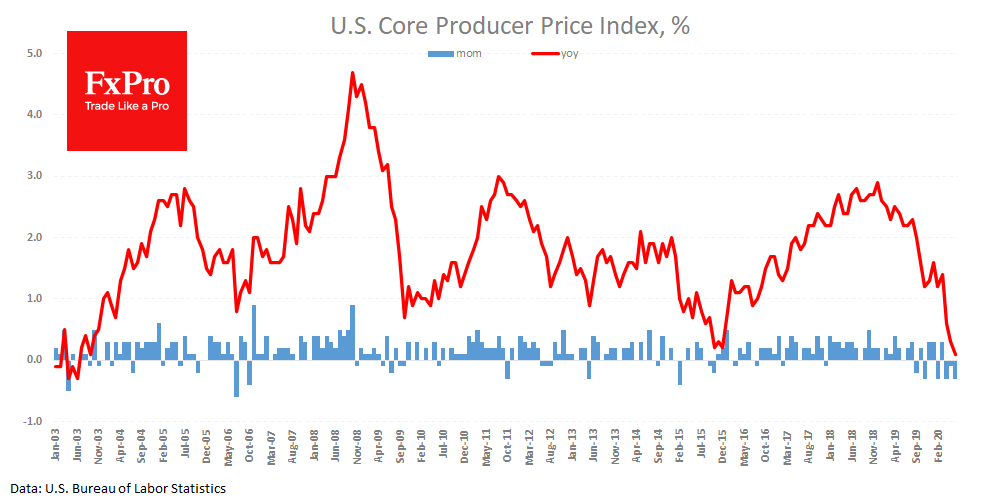

US producer prices returned to decline in June, another sign of a weakening economic recovery. On average, it was expected to duplicate the previous month growth by 0.4%, but instead, the PPI fell by 0.2%. The annual rate remained at -0.8% y/y, despite a spike in oil prices. The core index (excluding energy and food) has slowed its year to year growth to 0.1%, the lowest since 2003.

A fall in prices is a sign that manufacturers cannot shift the rising costs to customers, trying not to lose market share and sales. This is a crisis behaviour pattern that is often accompanied by a decline in employment. In 2009, for example, the annual growth rate of prices began to increase two months before the start of the trend for growth in the labour market.

The FxPro Analyst Team