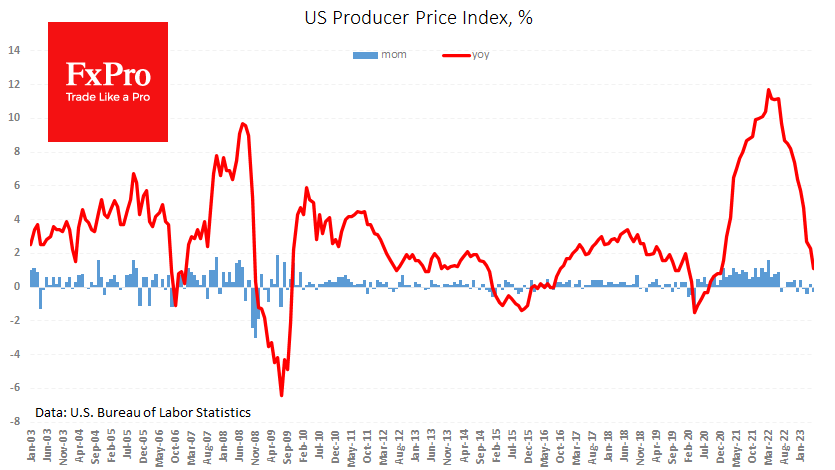

US producer prices fell stronger than expected, potentially reinforcing the dovish argument at the Fed. For May, PPI declined by 0.3% m/m, more than the expected 0.1%, and the index gained a modest 1.1% y/y after 2.3% a month earlier.

In contrast to the core CPI, the PPI shows a return to desired inflation numbers, with the monthly price growth rate well within the Central Bank target.

The core PPI, which excludes food and energy, added 0.2% m/m and 2.8% y/y. The annual rate was lower than 3.2% a month earlier and the expected 2.9%.

Were it not for a strong labour market and the resulting robust consumer demand, the producer price development should have been regarded as a leading indicator for the CPI. However, in a full employment environment, retailers can use the situation to support their margins by justifying it with increased interest expenses.

The FxPro Analyst Team