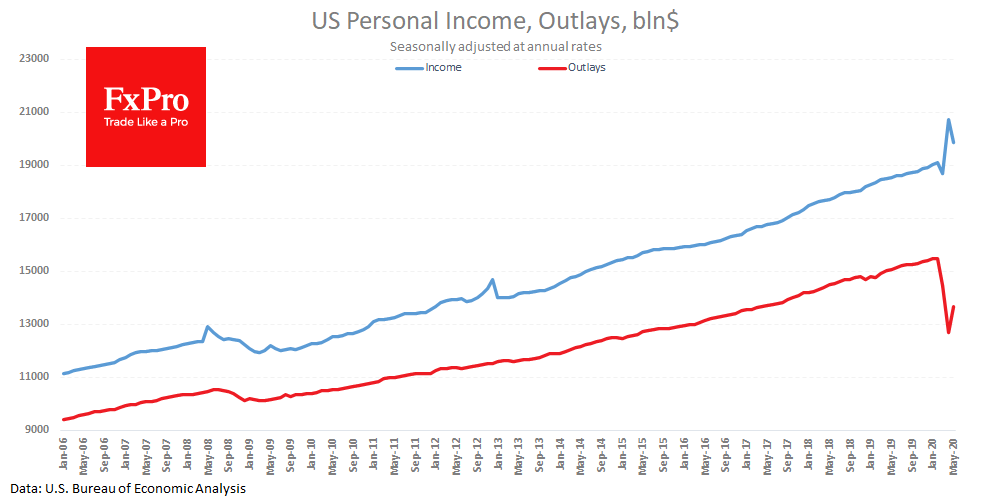

American households in May increased their spending by 8.2% while income decreased by 4.2% to April. This difference is due to a decrease in payments for employment support programs as the coronavirus restrictions in the US economy are lifted. The graph clearly shows that it is still too early to talk about restoring normal life.

To February (the last pre-COVID month), personal expenses are decreased by 11.6%. In contrast, personal disposable income over the same period increased by 5.3%. Fearing an uncertain future, the Americans are rapidly building up their savings.

For 12 months before February, they on average saved 8% of disposable personal income. In March, this figure rose to 12.6%, in April soared to 32.2%, remaining high in May – 23.2%.

Despite a rebound from historical highs, May’s savings levels still have no analogues for the entire period of research since 1959.

And this is a terrible sign for the economy. A 12% reduction in final consumption expenditures promises to whip off more than 8% of the country’s GDP. Without a sustainable recovery in demand, there will be no full recovery of employment and company income, which is alarming for markets.

The FxPro Analyst Team