Fed Chairman Greenspan once said, ‘If I’ve made myself too clear, you must have misunderstood me’. It seems that over the past decade and a half, the Fed has become increasingly transparent in its reasoning and expectations. Therefore, there is only a small chance that the markets misinterpreted Fed Chairman Powell’s speech yesterday.

Speaking at the ECB conference on Tuesday, the current Fed’s chief noted that the US is back on a “disinflationary path”. Of course, this was followed by caveats that more data is needed to decide on a rate cut. However, this is a very clear hint that a rate cut is imminent unless the data holds some unpleasant surprises.

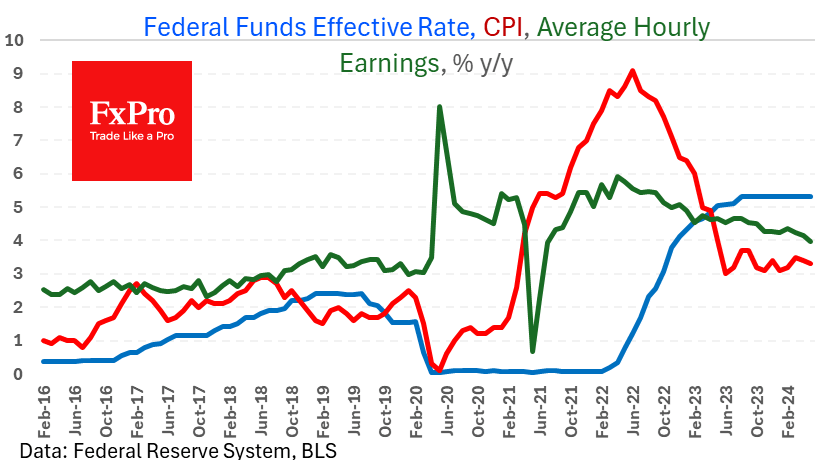

This is a very bold assumption. The core price index growth rate is drifting downwards (3.4%), almost half the peak rate of 6.6% in September 2022. The Fed’s preferred measure of inflation, the core PCE deflator, is slowing, falling to 2.6%, the lowest since April 2021. Meanwhile, the overall inflation rate has been in the 3.0-3.7% range for the past 12 months. However, we also note that current levels are still weighted above the 2% target. In addition, it is also worth considering that the Fed is targeting inflation at the long-run average. This means that it will take a long time to average out after more than three years of significant excess above the target.

An important reason for rising prices is the strong labour market, which is creating jobs faster than the trend rate. As a result, wages have been rising at a rate above 4% y/y for the past three years and above the rate of inflation for the past 13 months.

A tight monetary policy is likely to pressure the prices of food commodities and energy. Lower interest rates can quickly bring prices back to the upside, but stock markets seemed to have had enough, even with yesterday’s speech.

The Nasdaq100 added about 1.5% after Powell’s speech, closing above 20,000, from where it has sold off twice in the past two weeks. The S&P500 also had a record close. Also showing a noteworthy reaction was the dollar, which lost 0.5%. This small but important reversal emphasised the strength of resistance around the June highs and raised doubts as to whether the dollar will be able to stay within an upward channel. We may get the final answer to this when we see the market reaction to Friday’s employment report.

The FxPro Analyst Team