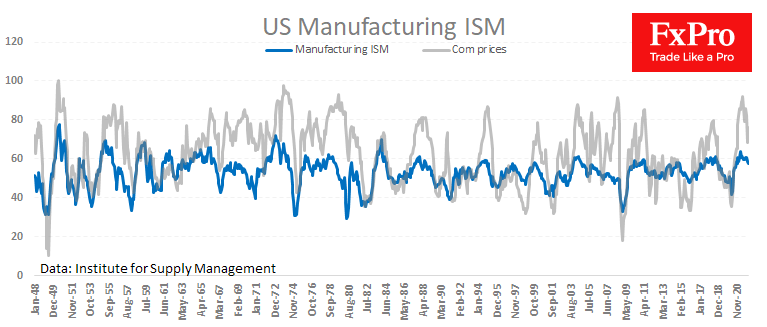

The US manufacturing ISM, an essential indicator for America’s business cycle, recorded a significant slowdown in January but managed to beat expectations. It had declined from 58.7 to 57.6 against expectations of 57.4.

The manufacturing ISM has slipped in the last two months from near 60, where it has held for most of last year, which coincides with the start of the Fed’s QE rollback. It will be interesting to see if the rate hike that the markets and businesses expect as early as March leads to a short-term downturn in business activity.

Perhaps the Fed is deliberately seeking to cool the economy to slow inflation. But the interim results are highly questionable. The price component jumped from 68.2 to 76.1 last month. Falling manufacturing activity (from 59.4 to 57.8) and new orders (from 61.0 to 57.9) drove the index down.

The ISM release might be the first wake-up call that the process of suppressing inflation will suppress the economy first.

The FxPro Analyst Team