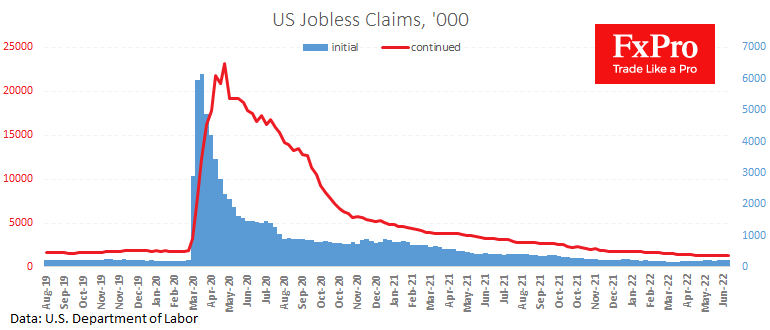

The US labour market seems to be letting off steam. Indicators ahead of official employment statistics point to a cooling of the market.

New weekly jobless claims data showed an increase to 235K against expectations of 230K and 231K a week earlier. The upward trend has been in place for the last three months after touching lows of 168K.

The open job vacancy figures for May are mainly in the same way. Their decline in the last six months from the historic highs should not be construed as a deterioration in the economy.

However, the current volume of applications and a slight decrease in open job vacancies are more likely to indicate a recovery from workers who have started to change jobs more actively. Perhaps they needed time to refresh their skills.

If we are right, Friday’s June data release could prove strong. Employment growth is expected to slow from 390K to 275K and wage growth to 5% y/y. Significantly higher data would indicate a labour market rotation. In this case, the 20-year highs for the Dollar look justified, and there remains further upside potential on expectations of further aggressive tightening from the Fed.

If the rate of new job gains continues to slow down, however, this would be an extremely negative signal that could halt the Dollar’s rally.

The FxPro Analyst Team