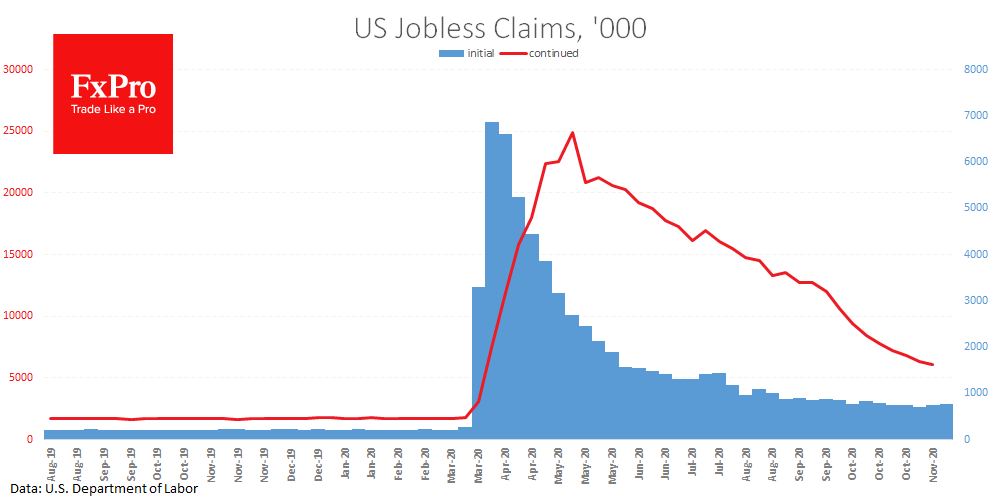

The US Initial claims number has been increasing for the second consecutive week, with a recent report showing 778K for the week to November 21 vs 748K a week earlier and expectations of a decline to 732K. The upward turn in this indicator threatens the sustainability of data improvement in response to record US morbidity rates.

Deterioration in weekly operational data also threatens the sustainability of the recovery, as we saw in previous monthly indicators.

The total number of claims fell to 6.071M in the week to November 14 (-299K), but the maintenance of the downward trend is at risk amid initial claims continuing to rise.

Traders should bear in mind that the number of continued claims is now 3.5 times higher than before the pandemic. Suspending the return to normal may suppress the recent market optimism, or pause it until the NFP reports are published at the end of next week and contain the retreat of the dollar.

The FxPro Analyst Team