At 10:40 GMT, UK MPC Member Tenreyro is due to deliver a speech titled “Productivity Matters: What is the state of trade?” at the Confederation of British Industry Economic Briefing, in Belfast. Audience questions are expected to follow. This event can result in moves in GBP crosses from any comments made.

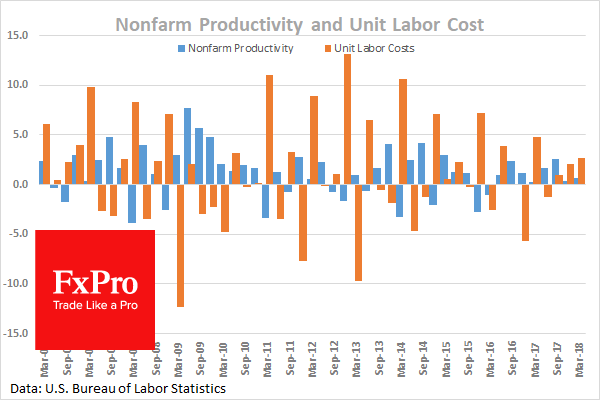

At 12:30 GMT, US Nonfarm Productivity (Q1) is expected to be in at 0.6% against 0.7% previously, showing efficiency slipping and ultimately upward pressure on inflation. Unit Labour Costs (Q1) is expected to be 2.8% against 2.7% prior, showing what has become a seasonal increase expected in this metric but these cost can be passed onto consumers. There is growing evidence, albeit anecdotal that labour costs are increasing as workers are becoming harder to find.

Trade Balance (Apr) is expected to be $-49.0B against a previous $-49.0B, rebounding off the low levels, at $-57.6B, not previously seen since 2008. USD crosses can see an increase in volatility from this data release.

At 12:30 GMT, Canadian International Merchandise Trade (Apr) is expected to be $-3.40B against $-4.14B previously. This fell to match the low of November 2016 last month and it is expected to come in off the lows today but still at very low levels. CAD traders will be closely watching this data release.

At 14:00 GMT, Canadian Ivey Purchasing Managers Index s.a. (May) is expected to be 69.7 against a previous 71.5. Ivey Purchasing Managers Index (May) was 70.4 previously. The data is expected to come in under last month’s reading which was the highest since 2011 and greatly exceeded expectations. This data is showing robust growth, continuing one of the longest positive runs with over 20 months above 50.0. CAD crosses can be moved by this data release.

At 16:00 GMT, UK MPC Member McCafferty is expected to deliver a speech discussing the economic outlook and monetary policy in a phone-in interview conducted by Iain Dale on LBC Radio. Audience questions expected. GBP crosses may be affected by any comments made. At 22:30 GMT, Australian AIG Construction Index will be released with a previous reading of 55.4 which is down from the April reading of 57.2. This data has been above 50 for fifteen consecutive months showing the strong run ongoing in the sector. AUD pairs can be influence by this data release.