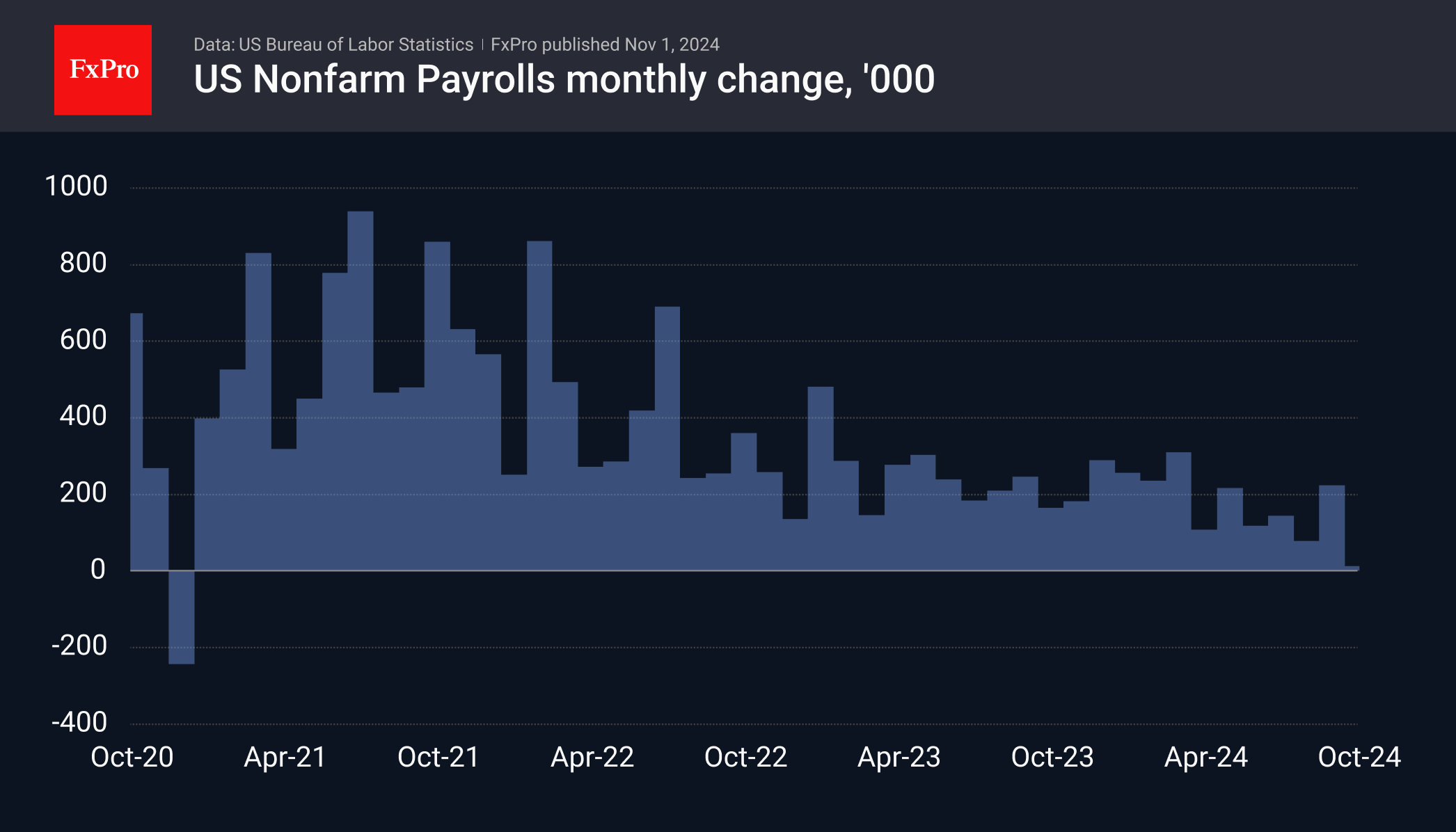

The US labour market showed a deafening failure, with non-farm employment rising by just 12k in October against expectations of 100-110k. The downward revision for September by 31k to 223k saved the overall employment change from contraction.

These weak numbers do not mean a recession is imminent. For now, we can only speak of a greater impact of Hurricane Milton and the Boeing strike on the labour market. Although the strike is not over, this dip should be considered a short-term phenomenon: next month’s numbers may show a significant improvement, and the impact on the market may be temporary.

Manufacturing continues its downward trend. Having cut employment by 46k in October, the sector has been in contraction mode since February, losing 93k jobs in that time. This is an unpleasant trend, but the decline is being offset by growth in the service sector – a typical move towards a post-industrial society. There was a much sharper decline in 2006-2008, without causing the economy to contract or accelerating the Fed’s key rate cut.

Another important leading indicator of inflation is the rate of wage growth. They rose to 4.0%, gently picking up from July’s 3.6% y/y. Historically, an acceleration in wage growth while inflation slows is a possible but infrequent and short-lived event. Wages, in this case, will mitigate disinflationary risks.

The stable unemployment rate of 4.1% indicates that the current low employment growth rate is not a catastrophe. Key rate expectations (debt market) also do not suggest a disaster. Expectations for a 25-point Fed rate cut next week have risen from 94.8% to 99.4%, maintaining a zero chance of a 50-point cut, although a month ago, the probability was 40%.

To summarise, although economists were significantly wrong in their estimates of employment change, markets did not see the data as information that caused them to overestimate the outlook for the coming months, as they did with the releases of the past few months.

The FxPro Analyst Team