In April, the US labour market maintained its impressive growth rate with 428K new jobs. This is higher than the expected 390K and in line with the increase a month earlier.

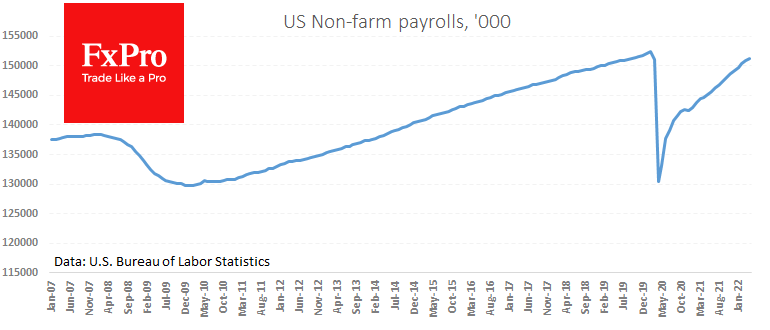

The current employment rate was 1.2 million below its peak in February 2020 and fully reflected the state of full employment. The unemployment rate is at 3.6%, the same as a month earlier, and only 0.1 points below the ‘bottom’ before the pandemic hit.

Average hourly earnings are up 0.3% for the month and 5.5% by April 2021. This is a high rate from a historical perspective, but it does not allow it to overtake the 8.5% price increase.

The new data is an additional reason for the Fed to stick with its policy tightening course to bring down inflation as the labour market is not showing any signs of cooling so far.

On the other hand, wage growth has stabilised and is no longer likely to push prices upwards on a broad front. Furthermore, it is also challenging to find data in the current employment report that would unambiguously cause the Fed to speed up its monetary tightening.

The balance of signals holds back fluctuations in the stock and currency markets but seems to leave them within an established trend of a stronger dollar and a weaker stock market.

The FxPro Analyst Team