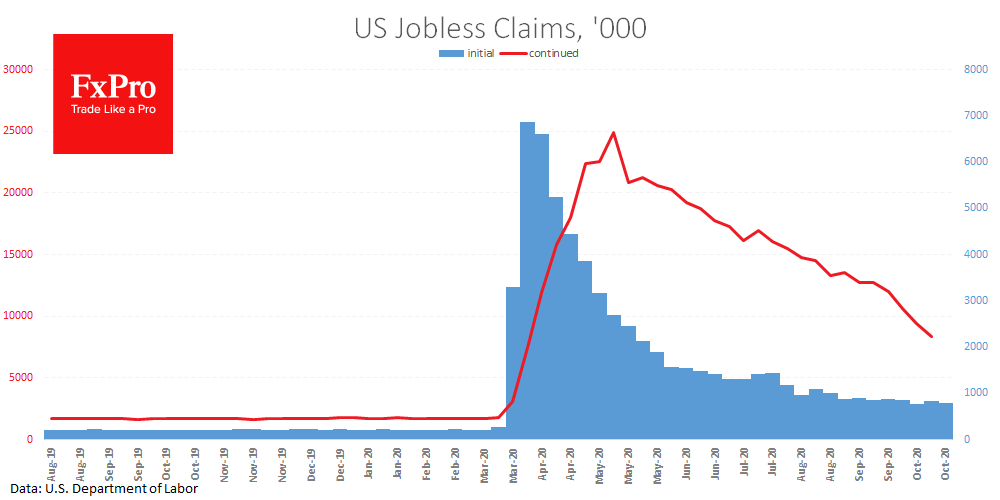

Weekly claims for unemployment benefits in the USA resume its decline. Last week, the number dropped from 842K to 787K. The new figures are still higher than two weeks ago, reflecting the negative impact of the jump in new coronavirus cases.

However, continued claims are falling with an accelerating pace, indicating that the labour market is continuing to create new jobs. The overall number fell to 8.37M for the week ending October 10th compared to 9.40M the week before with expected growth of 9.5 million.

This is positive news for US markets, including the US dollar and equities, as it reduces the degree of concern around the worst-case scenario. On the back of this report, the dollar may get a break after four trading sessions of decline, as well as containing the pressure on S&P500 since the beginning of last week.

The FxPro Analyst Team