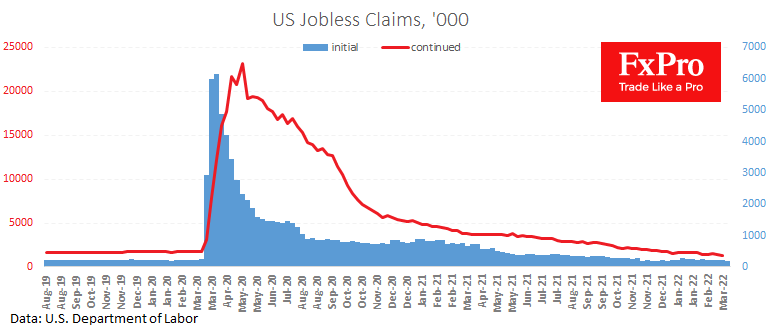

The number of initial jobless claims in the US collapsed to 187K last week, the lowest since 1969. Before the pandemic, the number was hovering around 220K, and we saw a complete recovery to these levels in the previous four weeks. The fresh data has marked a move into uncharted territory, indicating a further tightening in the labour market.

Such data further reinforces the need for the Fed to tighten policy as labour market further screws the inflationary spiral amid the initial jump in energy and commodity prices. A strong labour market is positive news for both stocks and the dollar as the central bank will have more room to tighten policy without fear of sending the economy into recession.

Right now, the market is banking on seeing six more rate hikes before the end of the year and the start of active selling off the balance sheet as early as in May-July.

The FxPro Analyst Team