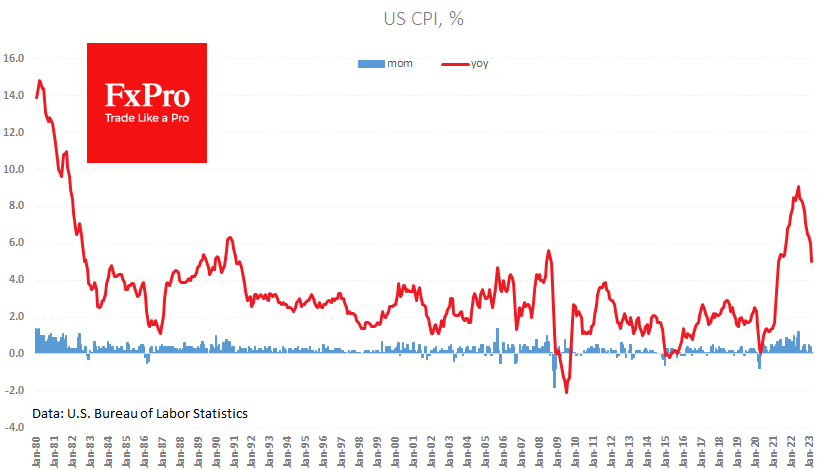

Last month, US inflation fell more than expected due to cheaper energy and food. The CPI rose 5%, down from 6% the previous month and just below the expected 5.1%. We had warned of this possibility.

However, it is challenging to see this as a surprise game-changer in the coming weeks. Moreover, core inflation – the real enemy of the Fed – accelerated from 5.5% to 5.6%. This is 1 point below the September peak, but it is further evidence that reversing this trend will take work.

Although trading robots reflecting the headlines have triggered a rally in equities and a sell-off in the dollar, only the latter has proved resilient. The bond markets, or “smart money”, shifted their expectations for the Fed’s next move slightly, putting the probability of a quarter-point hike at 68%, down from 72% the day before.

The USD’s reaction was much more pronounced. The Dollar Index has lost 0.85% from its pre-release level and is back at 101.0, close to the lows seen in early February. The technical picture is now more supportive of the USD bears. EURUSD and GBPUSD are testing their 10- and 12-month highs, respectively. This dynamic leads us to view the February pullback in these pairs as a correction, which they overcame by mid-April.

The following key levels on the way up are at 1.13 for the euro and 1.30 for the pound, both of which seem relatively distant targets given the accumulated fatigue from last month’s rally.

The FxPro Analyst Team