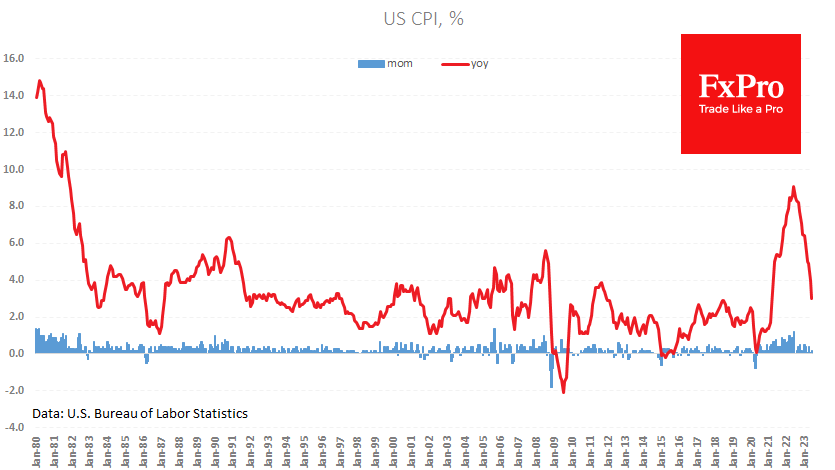

The US consumer price index slowed to an annual rate of 3.0% in June from 4.0% the previous month. This was slightly below the expected 3.1%. Core inflation slowed to 4.8% from 5.3%, and 5.0% expected. This is the ninth consecutive report where an indicator has been in line or weaker than expected, but we see a different market reaction.

This time the markets are confident, risk appetite is rising, and the dollar is falling as the latest report has fuelled speculation that the Fed will not need to stick to its plan of two rate hikes this year or will allow for a quicker reversal to policy easing next year.

Traders’ and investors’ attention should now turn to the Federal Reserve’s assessment of the latest data. In addition to the speeches by Barkin, Kashkari and Bostic, the Fed’s Beige Book will be released today, which will be used as the basis for the Fed’s observations at the July meeting.

While the Fed is often wrong in its forecasts, it is still the Fed that has the final say on interest rate decisions. Despite the constant inflation surprises, FOMC members remain hawkish in their comments, regularly pointing out that the fight against inflation is not over.

After the latest inflation report, the dollar index was close to its lowest level since April 2022, losing more than 12% from its peak last September. This decline creates additional pro-inflationary pressure, unlikely to please the central bank.

The FxPro Analyst Team