US consumer inflation data matched analysts’ average forecasts, but this did not prevent the markets from experiencing a spike in volatility. This mixed reaction to the economic report had previously only been seen in NFP reports or contradictory comments of the Central Bank governors during press conferences.

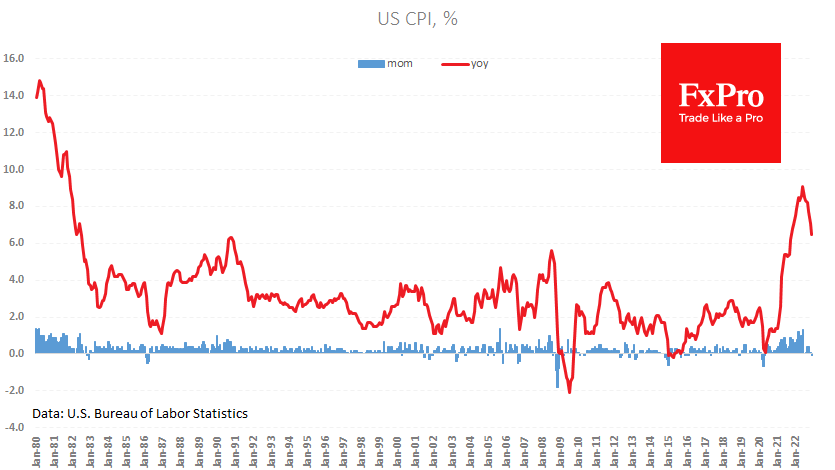

Thus, the Composite Consumer Price Index fell by 0.1% in December, and the annual price growth rate slowed to 6.5%. The core index (excluding energy and food) added 0.3% last month, but the annual rate declined to 5.7%. All data coincided with analysts’ forecasts and reinforced monetary market confidence that the FSR would only raise the rate by 25 points at the end of the February 1 meeting.

However, this coincidence with expectations did not keep us away from volatility. EURUSD has been moving in a range of almost 1%, going up and down again towards the lower boundary. The pair is precisely where it was before the publication, rattling short-term speculators’ nerves. EURUSD was stopped from going above 1.08 in June, increasing the interest for the current test of the level.

The Nasdaq100 is losing about 1% from the pre-release levels, but it has recorded a swing amplitude of 2.3% in under an hour. The battle for the 50-day moving average at 11375 is in full swing and will be concluded at the end of the day. The battle for 11500 (200-week average) might be even more revealing.

Gold has touched but quickly retreated from above $1900 for now. Although it crossed more than once in the previous two years, this level has been at the historic top of the price for nine years, so it attracts much attention and deal flow.

The FxPro Analyst Team