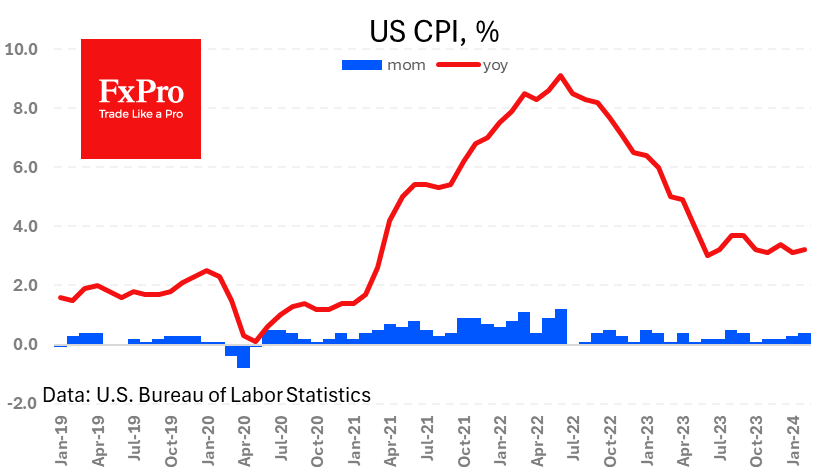

US consumer inflation beat expectations for the fourth month in a row. The CPI rose 0.4% m/m. The monthly growth rate has been rising since October. The year-over-year rate climbed to 3.2%, a bit above forecasted 3.1%.

Core CPI rose 0.4% m/m for the second month. The annual growth rate slowed to 3.8%, which formally left the index on a downward trajectory.

However, both the Headline and Core indices have risen over the past three months at a pace that would keep inflation well above 2% for months to come.

This is potentially good news for the dollar, which has been given a chance to rally after selling off since mid-February. However, we will be watching the reaction of markets, where hopes of a rate cut have not moved. The consensus still points to a cut in June with a 68% probability, down from 72% a day ago and 73% a week ago. These are not significant changes.

Clearly, the inflation surprised economists but barely market traders, and they still expect the Fed to ease policy in the middle of the year as prices have not yet risen dramatically.

The FxPro Analyst Team