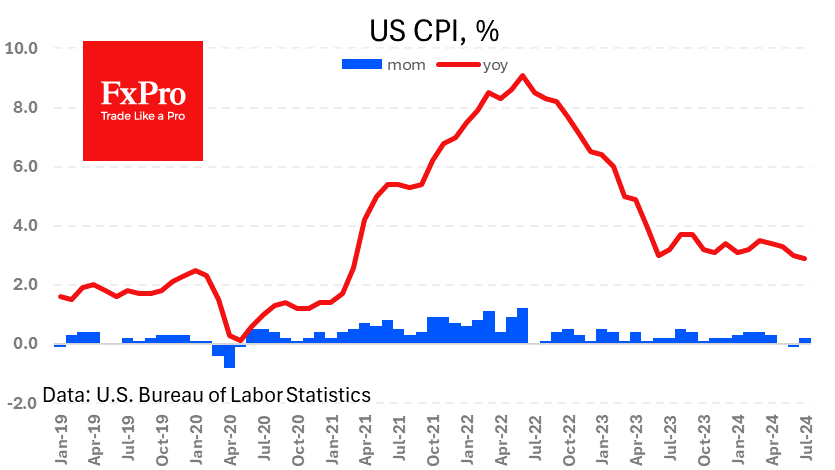

The US inflation report was in line with expectations, showing a 0.1 percentage point slowdown in July to 2.9% y/y for the headline measure and 3.2% y/y for the core measure, which excludes food and energy.

Tuesday’s producer price data showed a marked slowdown in the annual rate of growth, from 2.7% to 2.2% y/y for the headline index and from 3.0% to 2.4% for the core index. Just as importantly, the data came in below average analyst estimates, triggering a wave of dollar selling.

The markets have been convinced for some time that the Fed will begin a cycle of rate cuts in September. The main speculation is for a move of 0.25 or 0.50 percentage points. At the time of writing, interest rate futures are pricing in a 36% chance of a half-point cut at once. However, these expectations have weakened since 5 August due to reduced labour market concerns.

The inflation data alone does not provide a case for a rate cut, let alone a 50-point cut in September and a 100-point cut by the end of the year (the most likely scenario, according to FedWatch estimates). While inflation is on a downward trajectory, it’s been above the 2% target for three and a half years. And it will take a prolonged period of below-target price increases for the Fed to implement its “average over the period” inflation strategy.

It is also worth considering the impressive pullback in oil and agricultural commodity prices to 4–6-year lows. Their recovery from extreme lows is likely to be a side effect of policy easing and could trigger a new wave of price increases, as happened in the 1980s.

Only the labour market is seen as a real reason for the Fed to change policy, so mentioning its cooling was an important point in the official FOMC commentary on monetary policy. However, we believe that attention should also be paid to indicators of consumer activity, including Thursday’s retail sales data, the stagnation of which has become an important harbinger of the global financial crisis.

The FxPro Analyst Team