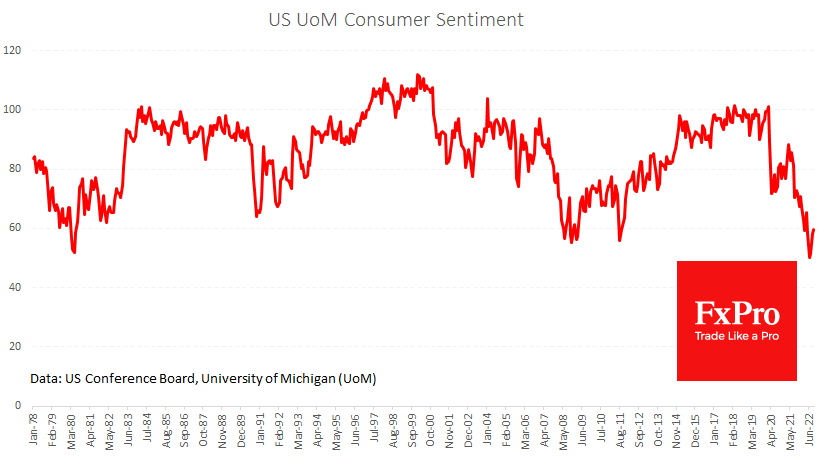

Preliminary estimates from the University of Michigan indicate that inflation expectations in the USA continue to normalise in September. Inflation in the “next year” is estimated at 4.8% compared to 4.8% a month earlier and a peak of 5.4% in July. People’s expectations correlate closely with current inflation levels and are therefore seen by many traders and investors as an early inflation indicator.

Potentially even more encouraging news from this front is that five-year inflation expectations have returned to 2.8% – close to the multi-year average until the middle of last year.

This shift indicates that inflation expectations are unanchored, which will give the Fed some room and allow it not to push the monetary brake pedal to the floor. Americans accustomed to low inflation quickly returned their expectations to the multi-year norm when they saw gasoline prices slip and import prices fall.

Although the Nasdaq100 index is now at its lowest level in about a month, the pressure on markets early next week could subside if market players discount the chances of a 100-point rate hike. They now stand at 16% versus 23% the day before. Zeroing in on this probability could support risk assets early next week.

The FxPro Analyst Team