The sell-off of technology companies, disappointing corporate reports from major banks, and the Fed’s reluctance to cut the policy rate until at least June caused the S&P500 to close in the red for the second day in a row. The broad stock index is at risk of a correction, as Wall Street’s forecasts for the fourth quarter are high. Issuers will have to work hard to justify them.

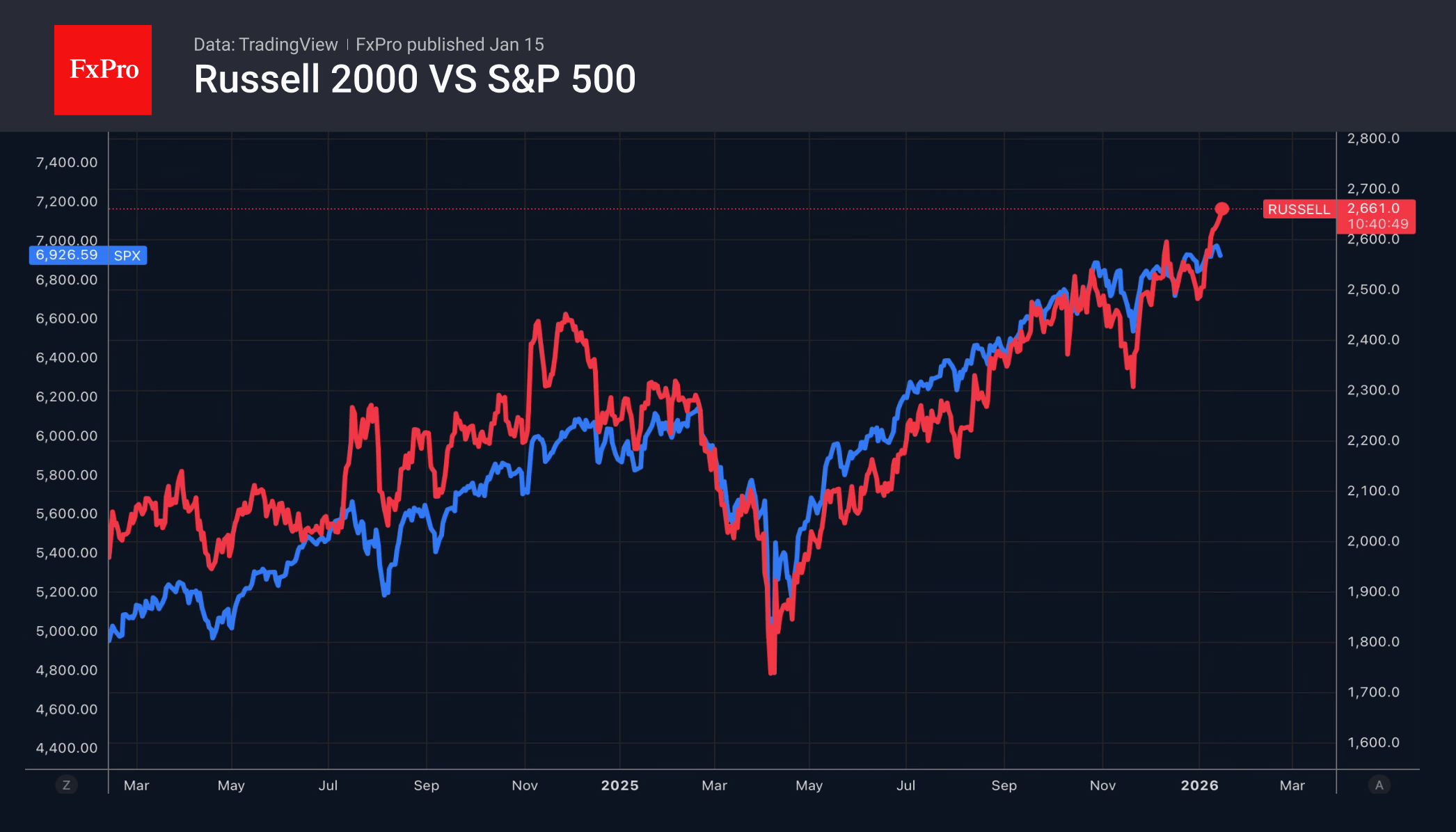

Investors are looking for reasons to get rid of tech giants. The magnificent seven are no longer seen as either the driving force behind the S&P500’s growth or a safe haven during turmoil, as they were during the pandemic. The market is undergoing active rotation as the Russell 2000 has outperformed the S&P 500 for nine consecutive days. This is the longest streak since the 1990s.

Bank of America expects corporate earnings for technology companies to grow by 20% in the fourth quarter. For other S&P issuers, estimates range from 1% to 9%. Forecasts for the Magnificent Seven are high, and it won’t be easy to justify them. This increases the risk of a broad stock index pullback.

The FxPro Analyst Team