US indices declined in unison with the dollar, although they usually go in the opposite direction. But not all is terrible.

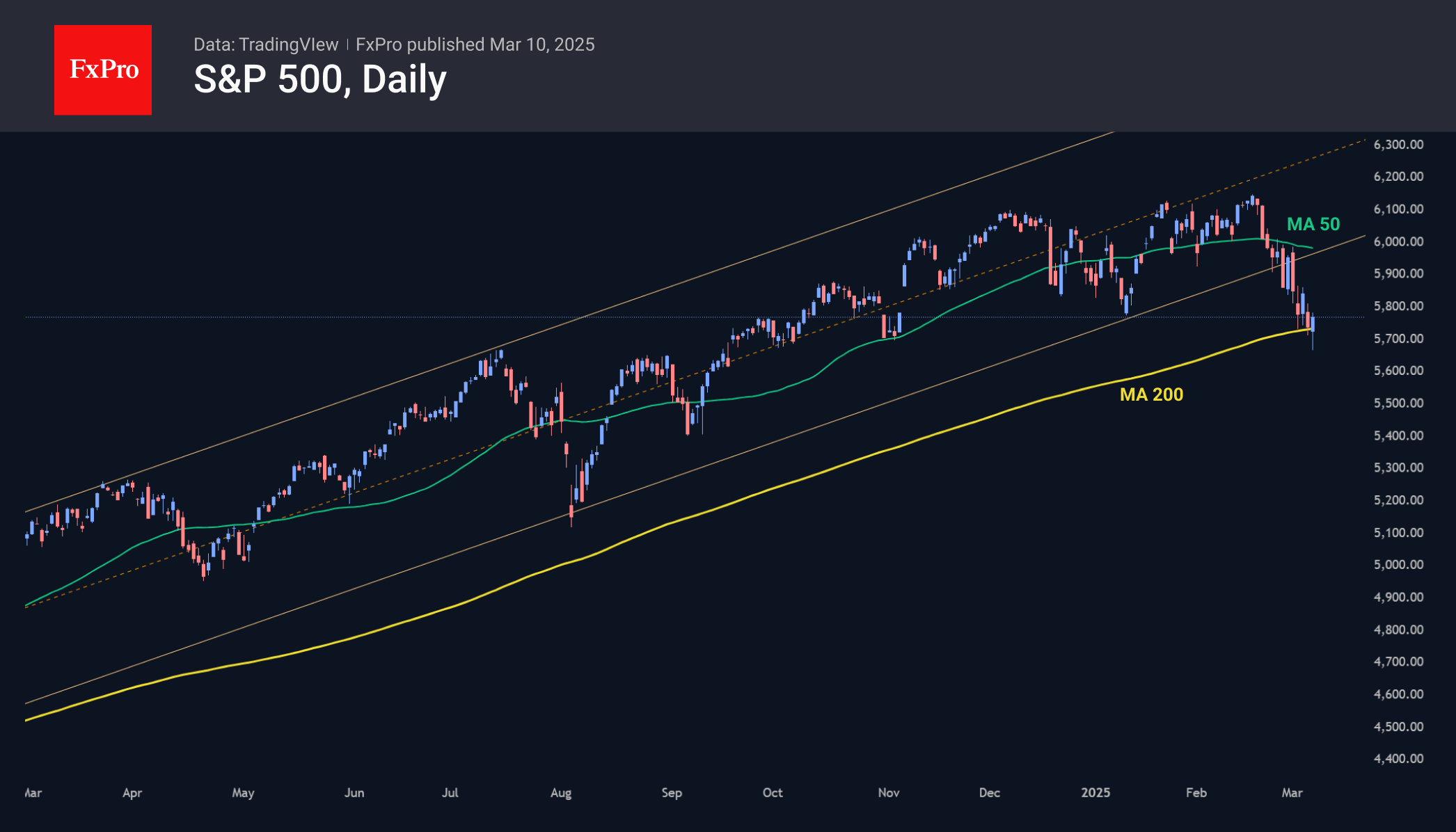

The S&P500 and Nasdaq100 indices were getting support on declines towards the 200-day moving average. That’s a long-term trend signal line for many of the big players. A failure below it could mean a regime change for stocks from ‘buying dips’ to ‘selling highs.’

The S&P500 has already broken a year-and-a-half upward trend and settled dangerously at levels just above 5700, testing buyers’ resolve almost daily. A failure of this support would activate an accelerated downside scenario into the 5200-5300 area.

For the Nasdaq100, which is now near 20000, a sustained move lower may not have meaningful headwinds until 18000. The beginning of recovery from this area will allow us to talk about the start of a new impulse with the potential to renew historical highs, as the accumulated oversold is whetting investors’ appetite.

It is a completely different story in Europe, where the German DAX40 continued to rewrite historical highs at its peak, showing an 18% increase since the beginning of the year. The new government’s plans to spend money on stimulus, setting aside self-imposed constraints in the form of budget deficits and debt-to-GDP ratios, sparked a sell-off in bonds. But this sell-off is in anticipation of a larger supply of government debt, not because of fears about Germany’s solvency. We are seeing a flow of money into euros and equities, not a flight from the region like during the Greek crisis.

The FxPro Analyst Team