Financial markets are gradually pulling back from the shocks of recent weeks, including the tariff clash and attempts on the Fed’s independence. While these stories promise to return more than once in sight, market participants are gradually realising that the point of maximum uncertainty is over.

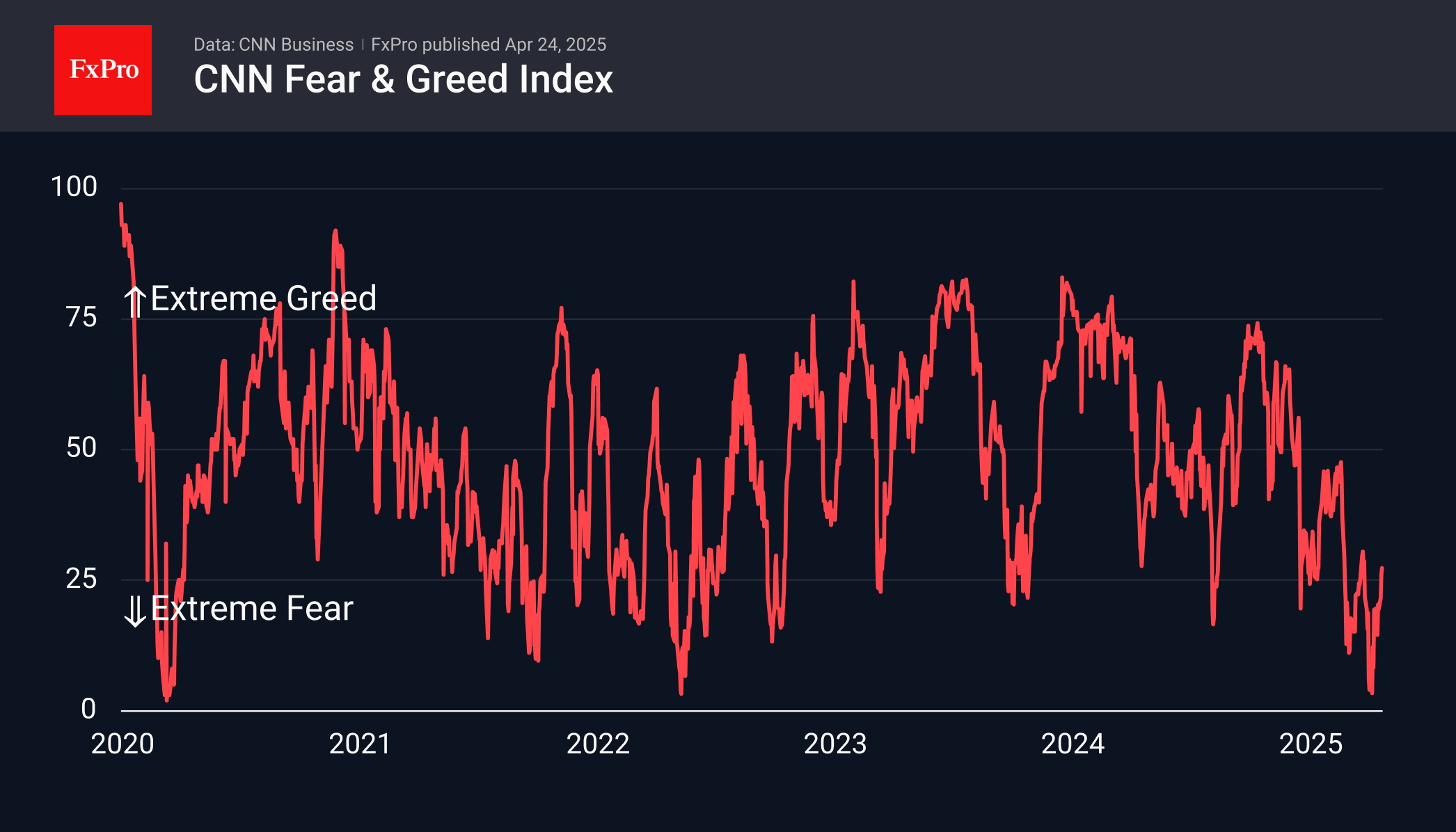

Sentiment in the stock markets has moved into ‘fear’ territory, with the Fear and Greed Index at 27. This is 24 points above the lows of 8 April and fits the typical recovery pattern after a bottom.

Stock indices have yet to boast a similarly impressive recovery, adding about 2% on the S&P 500 since the start of the week, still pinned at local resistance at 5500. The index remains near the resistance line of the downtrend that has been in place since late February. Barring politics, it is more favourable to be on the bullish side right now as the market recovers from the correction.

However, in the real world, the puzzle is more complicated. The Fed is not changing its hawkish rhetoric as it has done in previous episodes of similar selloffs. Tariff disputes continue with no apparent breakthroughs, and the news itself is highly contradictory, which hurts business.

We therefore anticipate a very uneven and protracted upside, and buying on news-sparked selloffs could be a working strategy for many weeks to come.

The FxPro Analyst Team