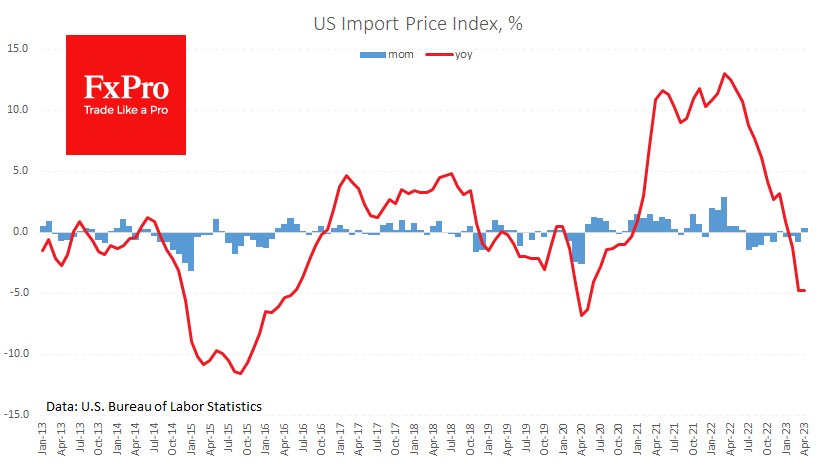

The US import price index came in much better than expected, with a decline of 4.8% y/y in April against expectations of -6.3% y/y. Last month the index rose by 0.4%, the biggest increase since May 2022.

The US is a huge importer, so this index’s development will significantly impact CPI inflation in the coming months. This index’s annual rate of increase began to fall sharply from April last year. It takes another three months for PPI to start declining and CPI to record a peak.

Perhaps imported inflation is the first early signal of how brutal the fight against inflation will be in the coming months. Investors and traders should remember that the Fed’s target is 2%. Inflation has slowed from 9.1% to 4.9%, but monthly price growth must still be on track.

In short, the consumer and import price indices released this week support the idea that the fight against inflation in the US is not over and that a prolonged pause (our main scenario) and another hike may be needed before a long rate plateau.

The FxPro Analyst Team