At 08:00 GMT, ECB President Mario Draghi is due to speak at the ECB Forum on Central Banking, in Portugal. EUR crosses can be impacted by any comments made.

At 08:30 GMT, ECB’s Praet is due to chair a discussion on the Macroeconomics of price and wage setting. EUR crosses can be moved by any comments made in relation to ECB policy.

At 11:00 GMT, ECB’s Praet is due to chair a panel discussion on the Macroeconomics of price and wage setting with US Fed’s Bullard and Central Bank of Ireland Governor Lane. EUR and USD crosses may be moved by any comments made in relation to Central Bank policy.

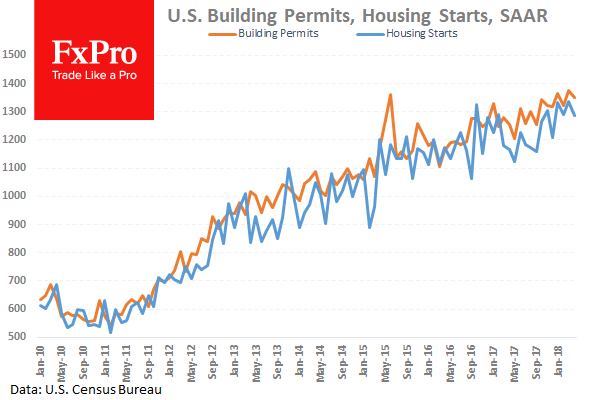

At 12:30 GMT, US Housing Starts (MoM) (May) is expected at 1.317M from a previous number of 1.287M. Building Permits (MoM) (Apr) is expected to come in at 1.350M with the prior reading of 1.352M. This data is expected to remain largely in line with the previous readings. These data points have been recovering since hitting lows in 2009 after the financial crisis of 0.46M and 0.49M respectively. The readings in February were the highest since those lows in both cases and these levels have yet to be matched or surpassed. USD crosses can see increased volatility around this data release.

Tentative – Global Dairy Trade Price Index is expected to be released with a previous reading of -1.3%. A negative reading at the beginning of this month reversed the positive reading from mid May. NZD pairs can be affected by this data release. Tentative – New Zealand Westpac Consumer Survey (Q2) will be released with a prior number of 111.2 recorded. NZD crosses can be affected by this data release.