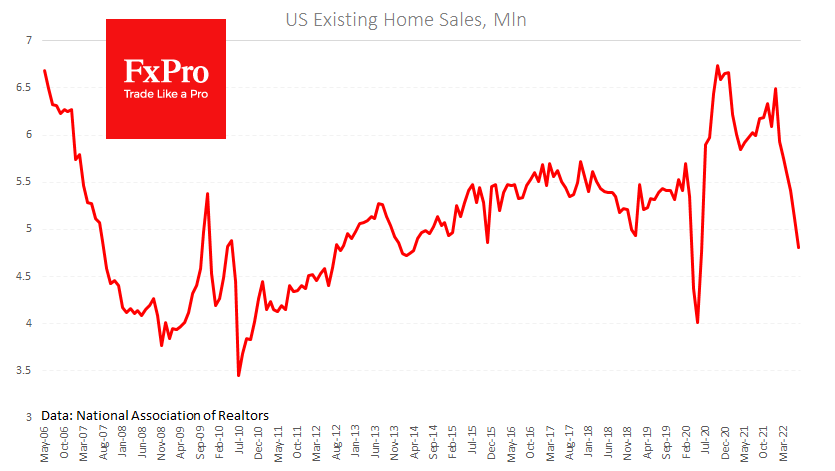

US secondary home market continues to shrink. Over July, they have fallen by a further 5.9%. The uninterrupted fall has been going on for the last six months, during which annualised home sales have fallen from 6.49 million to 4.81 million.

The inventory of unsold homes is back to a historical norm of around 4, at 3.3 months of current sales. The optimistic outlook suggests that we are now seeing “averaging”, meaning that sales will be below average for a while after a period of excessive activity and lots of logistical congestion.

The pessimistic view puts rising interest rates in the debt markets into the equation, knocking down interest in home purchases. And this situation promises to get even worse in the coming months because the Fed intends to raise rates even more.

So far, we are more on the side of the pessimists, suggesting that the housing market will cool down further in the coming months. The real estate market often outperforms and directs capital market trends, and its sustained cooling strengthens the case for a US recession.

The FxPro Analyst Team