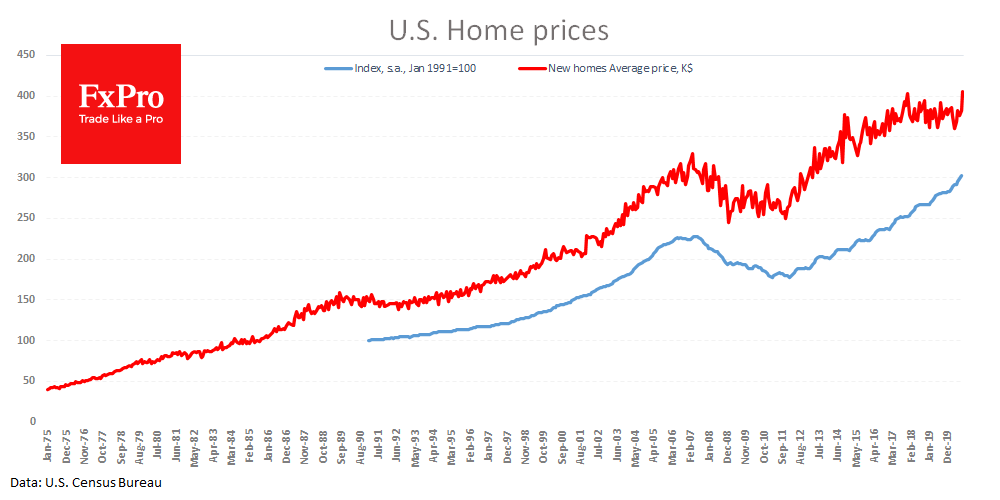

The US housing market continues to benefit from coronavirus through an ultra-soft monetary policy and lower spending for Americans who are mostly avoiding a drop in income. The FHFA Housing Price Index added 1.5% in August to an annual rate of 8.1%, the highest since 2006.

Separately, more specific but timely data on the prices of new homes for September was released on Monday. The average price of a new house sold reached $405.4K for the first time in history compared to $382.7K (+5.9%) a month earlier and $372.1K (+9%) a year earlier.

Looking solely at the housing market as a leading indicator of confidence and expenditure among Americans, one can put aside fears of a repeat recession. Prices for new homes have been slipping at $400K in the last three years but the support measures gave new impulses and may potentially lead to a repeat of the boom of the 1990s, in which the price of new homes from 1992 to 2007 more than doubled.

The FxPro Analyst Team