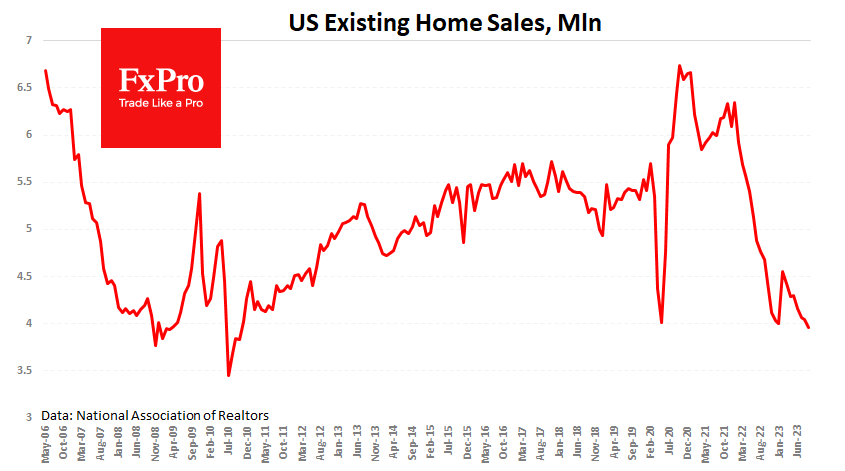

Sales in the secondary housing market in the US have fallen to an annualised pace of 3.96 million. At the peak of the downturn, the figure managed to stay above 4 million. Only during the darkest times for the US economy, during the global financial crisis, have secondary home sales been below that level.

Now, the reason is extremely high mortgage rates. The market’s main benchmark – the rate on a 30-year fixed mortgage – has reached 8 per cent, a level we haven’t seen since 2000. That’s a real shock to consumers, who have been fed by a long era of zero interest rates. As a result, the weekly index of mortgage activity has fallen to its lowest level since 1995.

In previous episodes of modern history, such low sales have coincided with problems in other sectors, forcing the Fed or the government to stimulate abundant demand. But don’t expect that to happen this time. It now appears that the central bank will look past the collapse in sales in the coming months. There is still a need to contain inflation, even if the process is initially hypertrophied in the housing sector.

At the same time, the stock of unsold homes stands at a comfortable 3.4 months of sales at the current pace – double the level at the start of 2022. Prices have also retreated from their pandemic trend, rising by more than 50 per cent in less than two years.

Meanwhile, falling home sales and prices are further bad news for banks, which are already sitting on huge “paper” losses due to the collapse in bond prices. As house prices fall, more Americans may choose to default on their monthly payments as their debt falls below the house price.

The FxPro Analyst Team