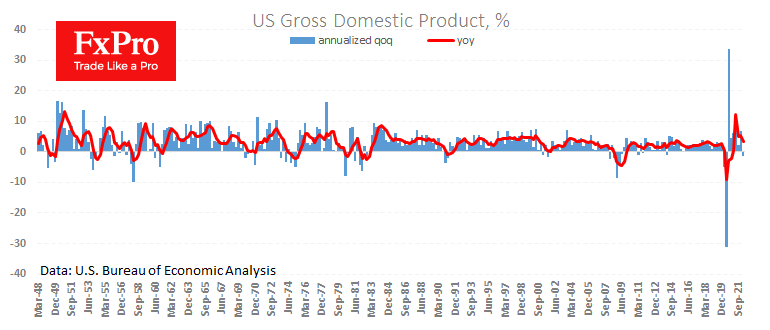

A revised estimate for the first quarter showed that US GDP contracted at an annual rate of 1.5% (previously reported at -1.4% and expected -1.3%). A major factor in the decline was a jump in net imports, a situation that the sharply appreciating Dollar in recent weeks can mitigate.

However, it is worth noting that final consumer demand has continued its recovery, indicating a solid foundation in the economy. At least for the time being.

Strong domestic consumption is a positive signal for the Dollar. It allows the Fed to continue its fight against inflation and leads interest rates to be higher than in Europe.

US GDP has a high chance of returning to growth in the current quarter by avoiding a formal recession (two consecutive quarters of contraction).

On the other hand, today’s data is hardly ideal for the stock market as it suggests better retail conditions than risky growth sectors.

The FxPro Analyst Team