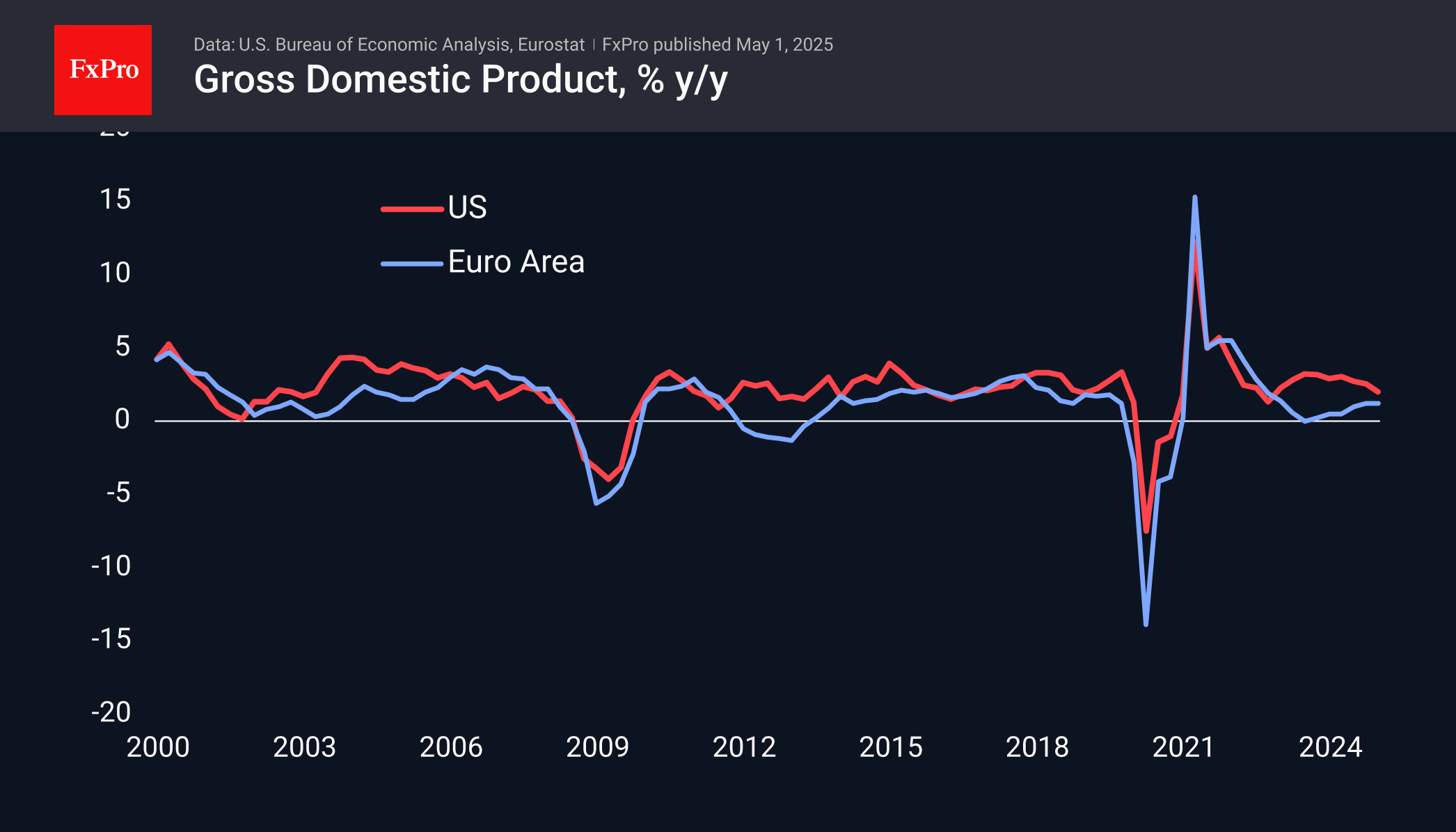

According to the first estimate, the US economy contracted by 0.3% in annualised terms in the first quarter (change from the previous quarter multiplied by 4). The figure initially sent shockwaves through the markets, as the average forecast had pointed to a 0.4% rise in the economy, down from the previous 2.4%. The figures sparked a sell-off in equity markets, prompting speculation that the economy is already facing the harsh effects of tariff disputes.

That’s generally true, but there are nuances. Fears of trade wars caused businesses and households to increase imports while tariffs were low. Import figures are subtracted from GDP, which is what caused the decline. The second strongest factor is the decline in government spending. A jump in private investment and the continued positive trend in consumer spending could not outweigh the negative factors.

The surge in imports will be followed by a crushing failure already in the second quarter. Still, consumer activity and business sentiment will be of greater concern, affecting the labour market. Consumer confidence has dropped to levels last seen during the initial 2020 lockdowns, a time marked by extreme uncertainty about the future.

The US jobs market is showing some weakness, with Tuesday’s data revealing the lowest number of new job openings since last September. This continues a normalisation trend after the remote work boom drove vacancies to record highs.

ADP’s labour market estimates released on Wednesday also showed an actual slowdown in hiring. For April, private sector jobs rose by 62K, almost half the expected 114K and up from 147K a month earlier.

Such data makes one look warily at Friday’s US labour market data for further signs of recession or a sharp cooling.

The FxPro Analyst Team